• Emirates NBD most profitable in the Middle East

• Austrian bank Raiffeisen saw profits surge, largely due to the Russia-Ukraine war

• Bank of China (Hong Kong) excelled in operating profit growth, CIR, and non-interest income

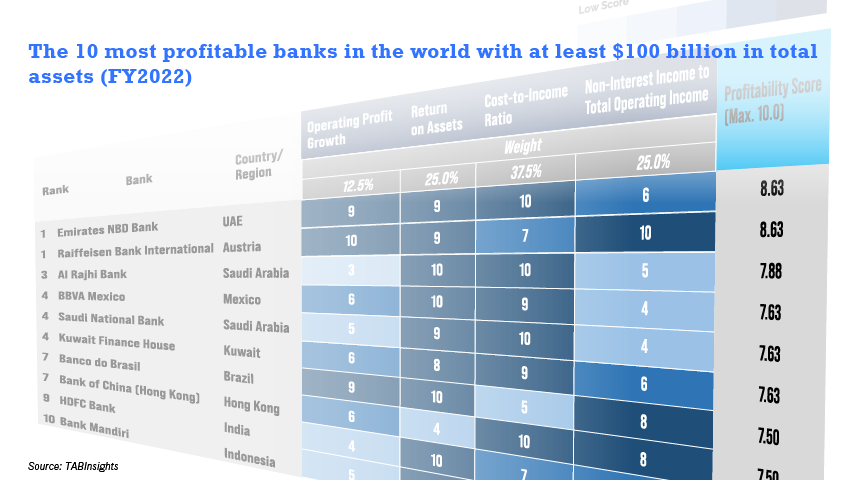

Emirates NBD Bank, Raiffeisen Bank International (RBI), and Al Rajhi Bank stood out as the top three most profitable banks in the world in 2022 amongst those with total assets exceeding $100 billion, according to the TAB Global 1000 World’s Strongest Banks Ranking 2023. Bank profitability is assessed through four key indicators: operating profit growth, return on assets (RoA), cost-to-income ratio (CIR), and non-interest income to total operating income ratio.

Middle East banks showcased robust profitability, contributing four out of the world’s top 10 most profitable banks. Additionally, the top 10 ranking comprised three banks from Asia, two from the Americas, and one from Europe

Emirates NBD most profitable in the Middle East

Emirates NBD Bank, Al Rajhi Bank, Saudi National Bank and Kuwait Finance House stood out as the most profitable banks in the Middle East. Emirates NBD Bank reported 50% year-on-year (YoY) increase in pre-impairment operating profit and 40% YoY rise in net profit in 2022. This was attributed to enhanced net interest margins, a better deposit mix, and robust expansion across all business segments, resulting in a rise in RoA from 1.3% in 2021 to 1.8% in 2022. Notably, the bank reduced its CIR from 34% in 2021 to 28.5% in 2022.

While Al Rajhi saw pre-impairment operating profit growth slow from 34% YoY in 2021 to 12% YoY in 2022, it outperformed Emirates NBD in terms of both RoA (2.4%) and CIR (26%). Saudi National boasted a higher RoA than Emirates NBD, standing at 2%, but its CIR was higher at 30%. Additionally, its non-interest income to total operating income ratio was 20%, lower than Emirates NBD’s 29%. Kuwait Finance House had a relatively higher CIR among the four banks, reaching 33% in 2022.

RBI saw profit surge, largely due to the Russia-Ukraine war

RBI, a major Austrian banking group with operations across Central and Eastern Europe, recorded a surge in profit, largely driven by the Russia-Ukraine war. Its RoA increased from 0.8% in 2021 to 1.8% in 2022, and its CIR improved from 61% in 2021 to 42% in 2022. The profit from Russia quadrupled to EUR 2.1 billion ($3.2 billion) in 2022, constituting 57% of the banking group’s net profit. Additionally, a one-time gain of EUR 453 million ($477 million) from the sale of its Bulgarian subsidiary in July 2022 to Belgian KBC Group contributed to RBI’s performance.

RBI achieved the highest non-interest income to total operating income ratio among these 10 banks, reaching 45% in 2022, up from 36% in the previous year. This increase was mainly fuelled by a strong 95% YoY increase in net fee and commission income, surpassing the 52% YoY growth in net interest income. Net fee and commission income from its foreign exchange business surged by 275% YoY, largely due to the Russian Central Bank’s measures on foreign currency restrictions and mandatory conversion. Additionally, its clearing, settlement, and payment services experienced 57% YoY growth due to increased transactions and higher fees in Russia aimed at reducing foreign currency deposits.

Although RBI generated significant profits from its Russian operation, it faces restrictions on transferring profits out of the country. Under regulatory pressure, RBI has downsized its Russian operations and is considering selling or restructuring the business.

.webp)

Bank of China excelled in operating profit growth, CIR, and non-interest income

In Asia, Bank of China (Hong Kong), HDFC Bank, and Bank Mandiri ranked as the top three most profitable banks in 2022 among those with total assets exceeding $100 billion. Bank of China (Hong Kong) outperformed HDFC Bank and Bank Mandiri in terms of operating profit growth, CIR, and non-interest income to total operating income ratio. Its cost-to-income ratio improved from 34% in 2021 to 29% in 2022, with operating expenses reduced by 0.5%. Although its non-interest income to total operating income ratio decreased from 40% in 2021 to 37% in 2022, it remained higher than the 27% for HDFC Bank and 24% for Bank Mandiri.

Nevertheless, the RoA for both HDFC Bank and Bank Mandiri were significantly higher than the 0.9% for Bank of China (Hong Kong). HDFC Bank’s RoA remained stable at 2% in the financial year ending March 31, 2023. Bank Mandiri’s RoA increased from 1.3% in 2020 to 1.9% in 2021 and further to 2.5% in 2022, driven by 66% YoY growth in net profit in 2021 and 47% YoY growth in 2022.

See the full list of the World’s Largest Banks here

See the full list of the World’s Strongest Banks here