Asia Pacific (APAC) banks are leading banking’s digital future, embedding intelligence, agility, scalability and resilience into core systems to meet rising transaction volumes and mobile-first, real-time customer demands.

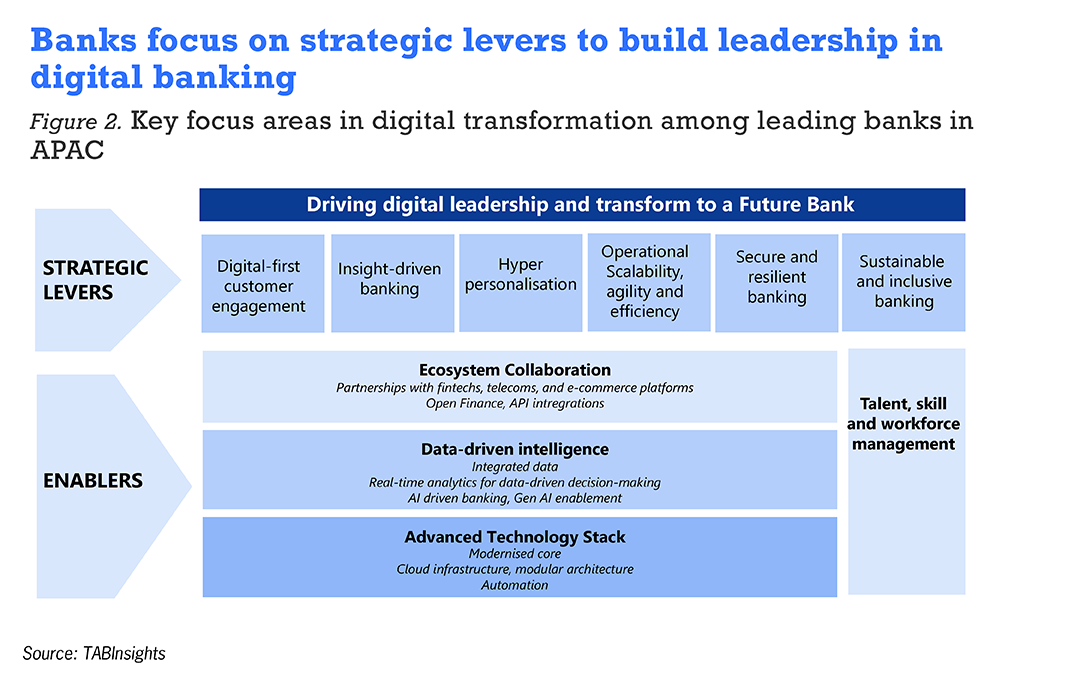

The ‘3Cs’ strategy—Curate, Connect and Collaborate—guides banks to hyper-personalise customer experiences, connect modular and scalable technology, and collaborate across ecosystems for embedded, real-time financial services.

The TABInsights–FIS report, 'Driving World-Class Bank Transformation in Asia Pacific’, based on interviews with over 10 major banks, along with TABInsights’ proprietary benchmarking data, uncovers the strategies and transformations shaping next-generation banking in one of the world’s most dynamic regions.

The APAC advantage: Why regional banks are winning the digital race

Home to about 40% of the world’s digital banks and a global leader in real-time payments, the APAC region is propelled by progressive regulation, mobile-first adoption and a tech-savvy population. Over 30% of the population are Millennials and Gen Z, driving demand for seamless digital experiences, while agile new digital challengers push incumbents to fast-track transformation.

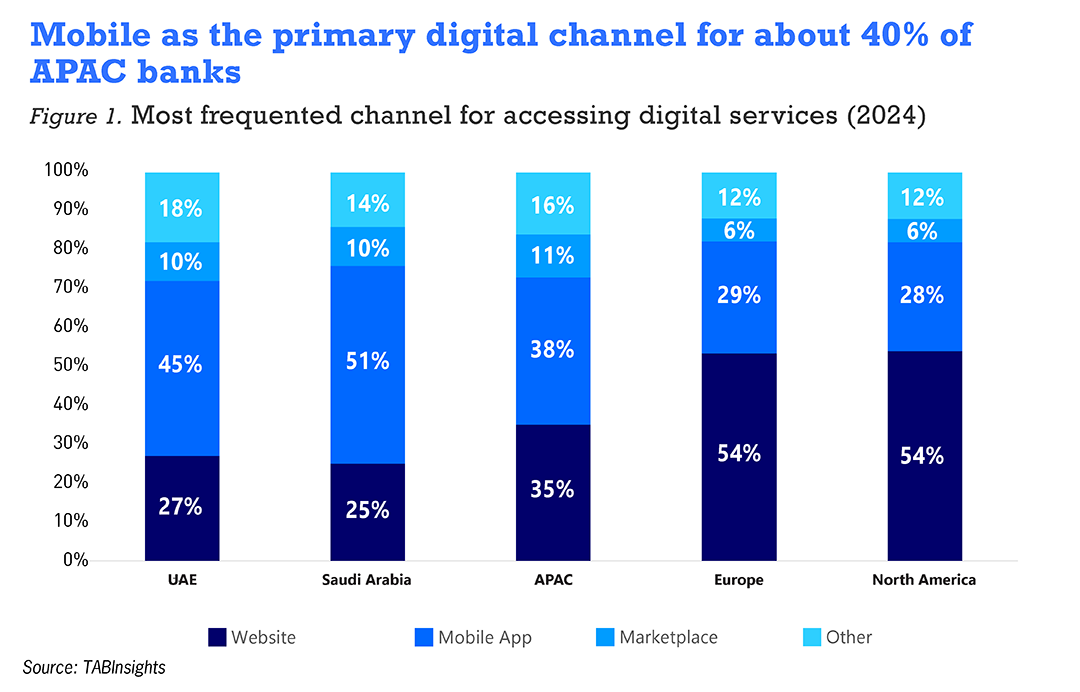

TABInsights research data shows over 63% of customers in the region are now digitally active, with mobile banking as the primary digital channel for 38% of banks. APAC banks’ tech investments are driving both innovation and profits. Leading APAC banks invest on average close to 5% of annual income in technology, with returns seen in a 46% cost-to-income ratio and 3.5% return on assets —among the highest globally.

Banks in the region also maintain strong liquidity positions, with an average net stable funding ratio (NSFR) of 131% and a liquidity coverage ratio (LCR) of 200%, offering the flexibility to continue investing in innovation.

Banks focus on personalisation, insight-driven banking and scalable tech stacks

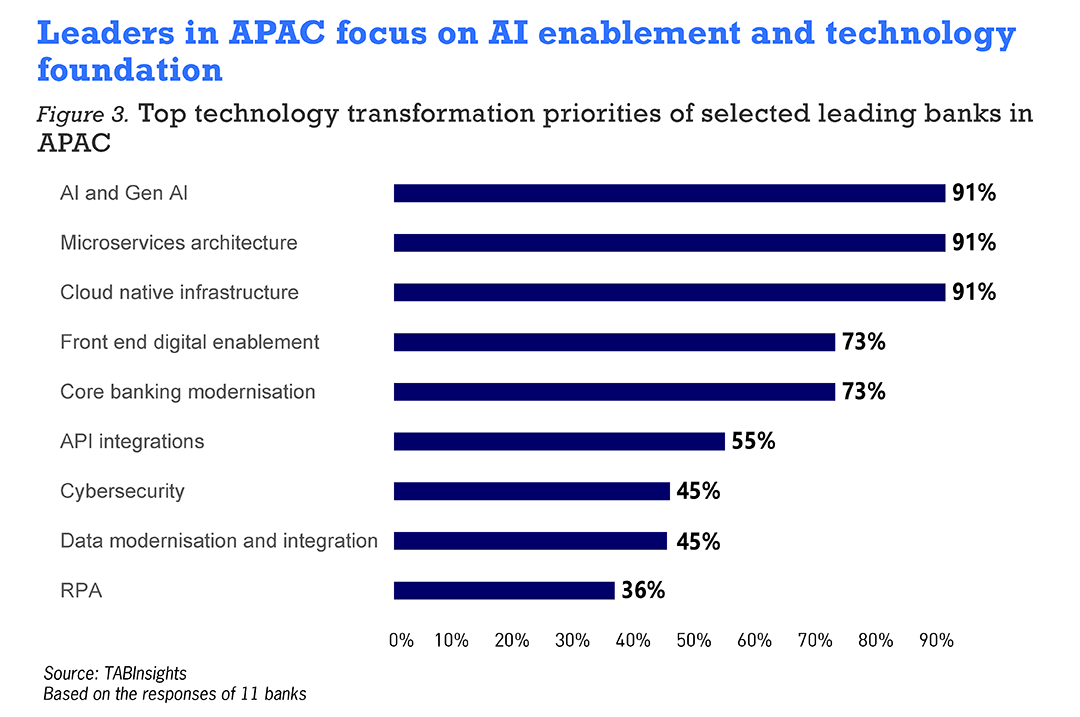

Interviews with senior bank executives from over 10 leading banks in APAC reveal their current strategies in technology transformations. Delivering insight-led, hyper-personalised digital customer experiences —while building scalable and resilient digital capabilities —remains a top priority.

Faced with surging digital transaction volumes and growing expectations for real-time, personalised banking, banks are reimagining digital journeys to be more intelligent, contextual and responsive. This includes moving beyond traditional delivery models to embed financial services seamlessly into customers’ daily lives—through superapps, fintech partnerships, and lifestyle-integrated platforms.

Banks rearchitect core tech for speed, scale and resilience

Banks are increasingly challenged by high costs, outdated architecture, scalability and flexibility limitations and integration constraints inherent in legacy core systems. Over 70% of surveyed banks are undertaking core modernisation. Rather than opting for “rip and replace,” most large banks are pursuing incremental, risk-mitigated approaches—such as hollowing out legacy cores, modernising architecture or deploying parallel systems for new product lines.

At the heart of this shift is a move toward composable architectures—modular technology platforms built from smaller, independently updatable and scalable components. These platforms leverage microservices (which perform discrete functions) and orchestration layers (which coordinate services in real time) to improve agility and reduce dependency on monolithic cores.

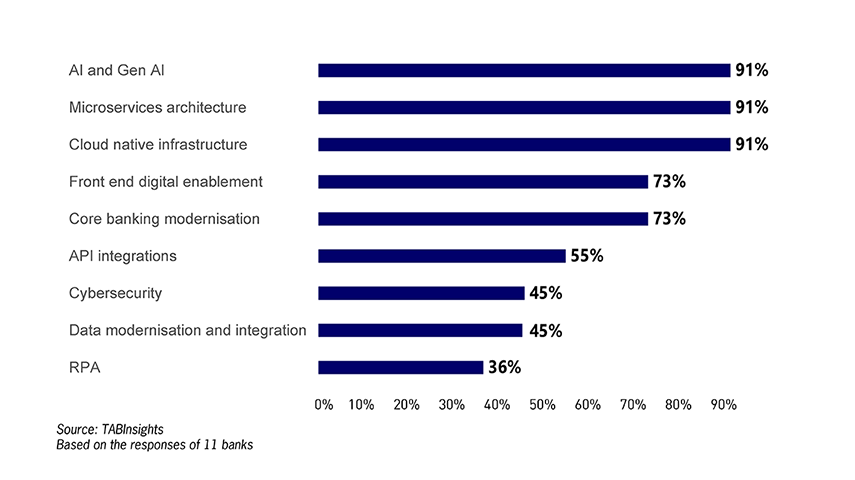

Nearly 90% of surveyed banks are now transitioning to microservices-based systems that support continuous deployment and real-time innovation.

Diverse core modernisation and hybrid cloud strategies reshape APAC banking

Based on responses, leading banks in the region are taking varied paths to future-proof their core foundations. Bank Central Asia (BCA), Indonesia transitioned to a microservices-based architecture with distributed databases, orchestration layers and a private cloud to boost scalability, performance and resilience.

Vietnam Maritime Commercial Joint Stock Bank (MSB) replaced its mainframe with open architecture to double transaction capacity and reduce maintenance costs.

Many banks target a lean core. RHB Bank in Malaysia shifted statements, product innovation and bundling outside its core system, improving speed and flexibility and product configuration efficiency. Another, Philippine-based bank moved its general ledger and reporting functions out of core banking system.

As banks seek deeper integration into digital ecosystems, they are expanding and advancing their application programming interfaces (APIs), enabling a shift from service providers to platform orchestrators—embedding financial services wherever customers need them. For example, Philippine-based RCBC’s Digital 2.0 initiative includes an API Marketplace that enables external partners to plug into the bank’s infrastructure, co-create services and launch platform-based offerings—driving financial inclusion and innovation at scale.

Cloud strategies evolve: hybrid takes the lead

Cloud has become a key enabler of speed and scale and adoption is accelerating. However, regulatory concerns around data sovereignty and risk management are increasingly prompting banks to adopt hybrid cloud strategies. Many banks retain mission-critical workloads on-premise or in private cloud, while migrating selected compute-intensive or customer-facing applications to the public cloud.

Vietnam Technological and Commercial Joint Stock Bank (Techcombank) adopted a cloud-first strategy, migrating major compute workloads to the cloud, while maintaining on-prem backups for resilience. This, along with broader digital enablement, allowed the bank to grow its customer base by 150% over four years. Tien Phong Commercial Joint Stock Bank (TPBank) focused on private cloud, upgraded its core and is exploring a dual-core model—scaling transactions and customer base while reducing hardware costs.

AI moves from the fringe to the core as banks scale its applications enterprise-wide

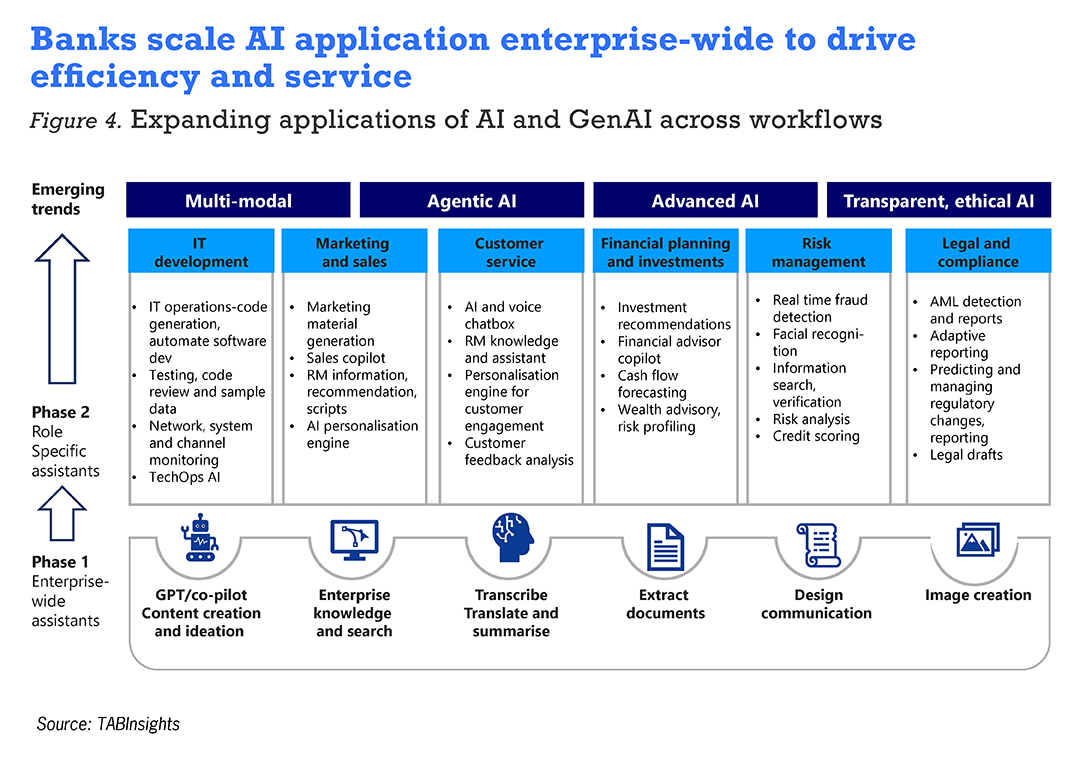

Advancements in AI are proving to be a gamechanger, accelerating adoption. Nine out of 10 leading banks aim to scale AI and generative AI (GenAI) use cases across functions. Many banks plan to expand AI applications beyond operational efficiency, applying them to personalisation, fraud detection and risk management.

To realise effective AI outcomes, banks must transform their data foundations and support them with scalable infrastructure. Leading banks are investing in scalable data lakes, real-time data streams and decentralised data ownership across domains through a data mesh architecture.

Banks are progressing from basic AI automation to role-specific models that optimise specialised workflows and enable more tailored, context-aware customer experiences.

Kasikornbank has developed its own large language model (LLM) and a coding assistant to enhance software development productivity and actively uses AI in credit scoring, underwriting, marketing and fraud detection. Hong Leong Bank launched an AI personalisation engine combining AI, big data and cloud to deliver real-time recommendations and has deployed AI for workflow automation, customer engagement and voice bots.

New developments such as multimodal AI —which interpret and act across multiple channels —and Agentic AI —which enables autonomous decision-making and system collaboration —are emerging. But as innovation and adoption scale, so does the need for scrutiny and risk management. Leaders are prioritising AI governance by investing in Centres of Excellence, model transparency, and secure, ethical deployment frameworks.

Resilience is now a core design principle

Transformation is no longer just about innovation—it’s also about resilience. With rising cyber risks and tighter regulations, banks must embed security, compliance and failover mechanisms into the core.

To this end, leading banks are adopting zero-trust architectures that continuously verify every user and device. and are deploying active-active systems to ensure uninterrupted service delivery even during outages or failures.

Complementing these efforts, AI-powered regulatory technology (RegTech) tools and real-time risk analytics are being integrated to help banks meet increasingly complex regulatory requirements while proactively detecting and mitigating cyber threats.

The future pathway to reinvention

The next chapter for APAC banking leaders will demands more than transformation—it will require full reinvention. To stay ahead, banks must modernise their core with modular, API-first and cloud-native platforms; scale AI responsibly with the right governance; and shift from standalone products to ecosystem-based engagement. Resilience must be designed into every layer of technology, not added as an afterthought.

Preparing for what’s next also means embracing frontier technologies like quantum computing, decentralised finance, immersive customer experiences and environmental and social and governance (ESG)-aligned innovation. But none of this will succeed without the right people. Future-ready institutions will be those that invest equally in technology and talent—nurturing agile, AI-fluent teams capable of navigating constant disruption.

As AI and automation reshape roles, reskilling and upskilling will be essential to prepare the workforce for new ways of working. Equally critical is leadership. Banks need transformational leaders who can drive strategic change, embrace disruption and lead integration into broader digital ecosystems.

For more insights and detailed findings, download the full report here.