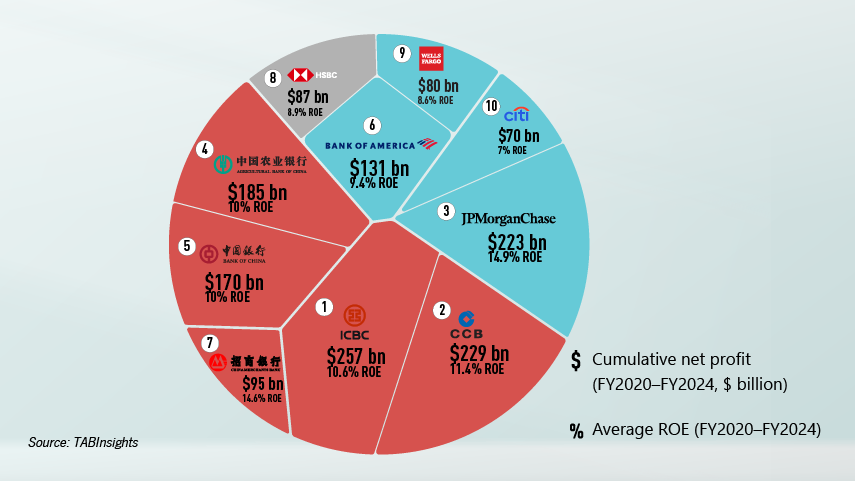

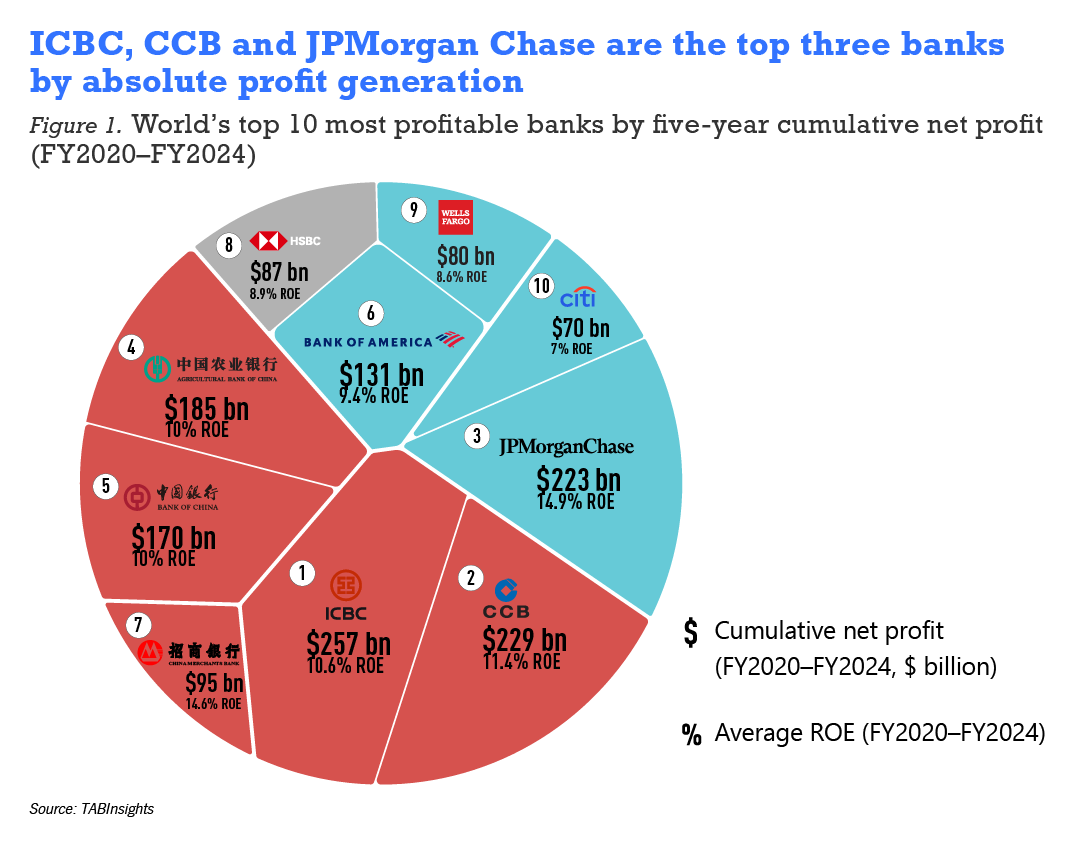

In absolute terms, profit generation between 2020 and 2024 was led by Chinese and US megabanks with vast balance sheets, deep domestic market penetration and entrenched roles in global trade and finance. The top 10 banks by cumulative net profit generated a combined $1.5 trillion over the five-year period.

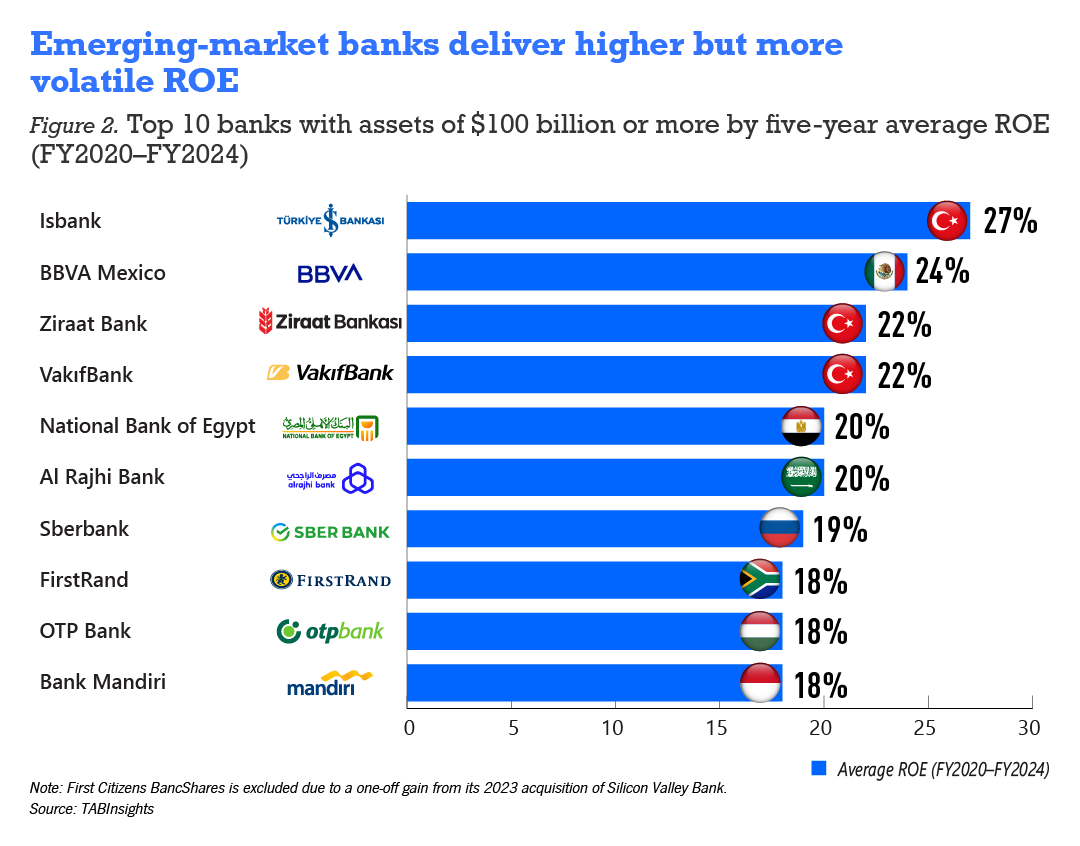

In contrast, among banks with assets exceeding $100 billion, the highest average return on equity (ROE) was achieved by institutions operating in emerging markets, including Turkey, Mexico, Egypt, Saudi Arabia, South Africa and Indonesia.

Global banking profitability during this period was shaped by major macroeconomic disruptions, including the Covid-19 pandemic, supply-chain dislocations, global inflation, aggressive monetary tightening and rising geopolitical risk.

Chinese banks lead absolute profits through scale

Chinese banks accounted for half of the top 10 institutions ranked by cumulative net profit between 2020 and 2024. Industrial and Commercial Bank of China (ICBC) ranked first with $257 billion, followed by China Construction Bank (CCB) at $229 billion, Agricultural Bank of China (ABC) at $185 billion and Bank of China (BOC) $170 billion.

These results reflect the sheer scale of China’s banking system rather than unusually high margins. Chinese megabanks benefit from vast domestic deposit bases, dominant market shares and structurally low funding costs supported by state ownership and policy alignment. Their balance sheets are deployed across infrastructure, manufacturing, local government financing and large corporate lending, which has historically supported stable earnings.

However, volatility increased between 2020 and 2024 amid the pandemic and a prolonged property-sector downturn. Despite being the world’s largest profit generators, the Chinese Big Four delivered only mid-range average ROE of between 9.6% and 11.4% over the five-year period, reflecting a trade-off between stability and capital efficiency. Returns were constrained by conservative capital allocation, controlled leverage, policy objectives and regulatory guidance limiting pricing power in consumer finance and small-business lending, alongside directed support for stressed sectors such as real estate.

China Merchants Bank stands out among its domestic peers. Ranked seventh globally with $95 billion in cumulative net profit, it achieved an average ROE of 14.6%, reflecting a more market-oriented business model focused on affluent retail clients, wealth management and fee-based income.

US and European banks show smaller scale and mixed returns

JPMorgan Chase ranked third globally by cumulative net profit, generating $223 billion between 2020 and 2024 and posting the highest average ROE among the top 10 banks at 14.9%. Its performance reflects a diversified revenue base spanning investment banking, markets, payments and asset management. Earnings were supported by strong capital-market activity during 2020–2021 and widening net interest margins as US interest rates rose sharply from 2022 onwards.

Western banks operate in highly competitive markets, where growth relies heavily on fee-generating businesses. Post-global-financial-crisis regulatory reforms — including higher capital and liquidity requirements — have reduced leverage and increased compliance costs, structurally capping ROE.

While interest-rate hikes boosted net interest margins, they also raised credit risk and provisioning pressures. Compared with Chinese banks, Western institutions lack the balance-sheet scale to match absolute profit levels, leaving earnings more cyclical and sensitive to capital market activity and interest rate shifts.

Bank of America earned $131 billion in cumulative net profit over five years with an average ROE of 9.4%. Wells Fargo earned $80 billion with an ROE of 8.6% while Citigroup posted $70 billion and the lowest ROE in the top 10 at 7%. Regulatory penalties, restructuring costs and earnings volatility weighed heavily on Wells Fargo and Citigroup. HSBC generated $87 billion in cumulative net profit with an average ROE of 8.9%, illustrating the challenges of operating across fragmented regulatory regimes, uneven regional growth profiles and ongoing restructuring.

Overall, Western financial hubs have experienced a relative decline in historic profit dominance. HSBC’s position as the sole UK representative among the top 10 highlights a broader shift in global profit generation eastwards, reflecting ongoing economic rebalancing.

Emerging-market banks deliver high but volatile ROE

When ranked by five-year average ROE, the top 10 banks with assets exceeding $100 billion were in emerging markets. Turkey’s Isbank recorded the highest average ROE at 27%, followed by BBVA Mexico at 24%. Two other Turkish banks, Ziraat Bank and Vak?fBank, also appear in the top 10, each with ROE around 22%. Banks from Egypt, Saudi Arabia, Russia, South Africa, Hungary and Indonesia complete the list, with average ROE ranging from 18% to 20%.

High ROE in these markets is driven by strong margins, rapid loan growth and, in some cases, inflation-linked balance-sheet expansion. In Turkey, exceptionally high inflation and sharp interest-rate swings widened net interest margins, driving ROE to extreme levels. Isbank’s ROE surged from 11% in 2020 to 49% in 2022 before falling to 19% in 2024, reflecting macroeconomic sensitivity. Its peers, Ziraat Bank and Vak?fBank, show similar patterns, though less dramatic.

By contrast, BBVA Mexico demonstrates sustainable growth, with ROE steadily rising from 16% to 27%, underpinned by a predictable regulatory environment, financial inclusion, digital banking adoption and diversified revenue streams. National Bank of Egypt and Indonesia’s Bank Mandiri also recorded consistent improvement, underpinned by economic growth, structural reforms and digital transformation.

Specialised business models and dominant market positions further enhanced returns. Saudi Arabia’s Al Rajhi Bank leveraged Shariah-compliant banking, low-cost funding and market leadership to sustain an average ROE of 20%. South Africa’s FirstRand delivered an average ROE of 18%, benefiting from a diversified franchise and disciplined risk management, despite operating in a low-growth economy.

Russia’s Sberbank illustrates the impact of geopolitical shocks, with ROE collapsing to 5% in 2022 following international sanctions before rebounding thereafter. Hungary’s OTP Bank similarly recovered from pandemic- and energy-related disruptions, demonstrating resilience in a volatile environment.

Chinese banks profit dominance reflect economic scale, systemic stability and policy alignment. Western banks continue to rely on deep capital markets and shareholder-driven models, resulting in cyclical earnings profiles. Emerging-market banks, meanwhile, combine structural growth, margin opportunities and strategic positioning to deliver higher ROE — albeit with significantly greater volatility. While some institutions experienced extreme swings driven by inflation, interest rate shocks or geopolitics, others sustained steady returns through stable economies and diversified business models. Across all markets, the ability to manage risk and strengthen governance will remain critical to sustaining profitability through future cycles.

View the complete ranking of the World's 1000 Strongest & Largest Banks.