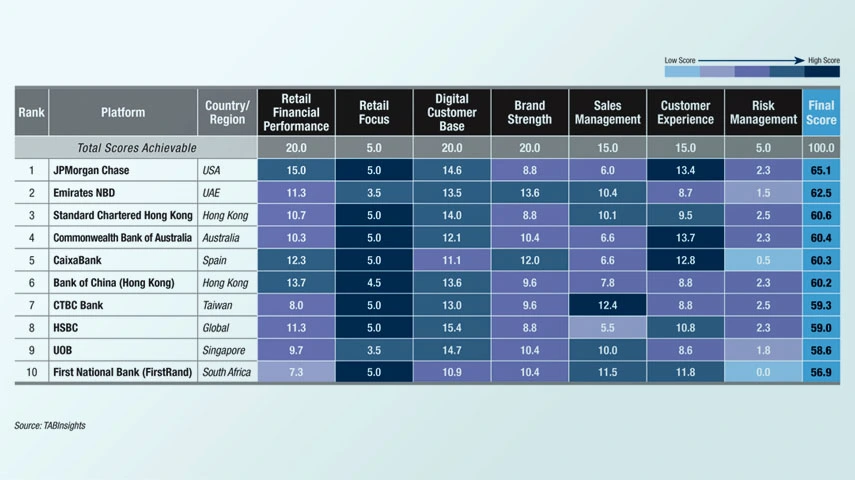

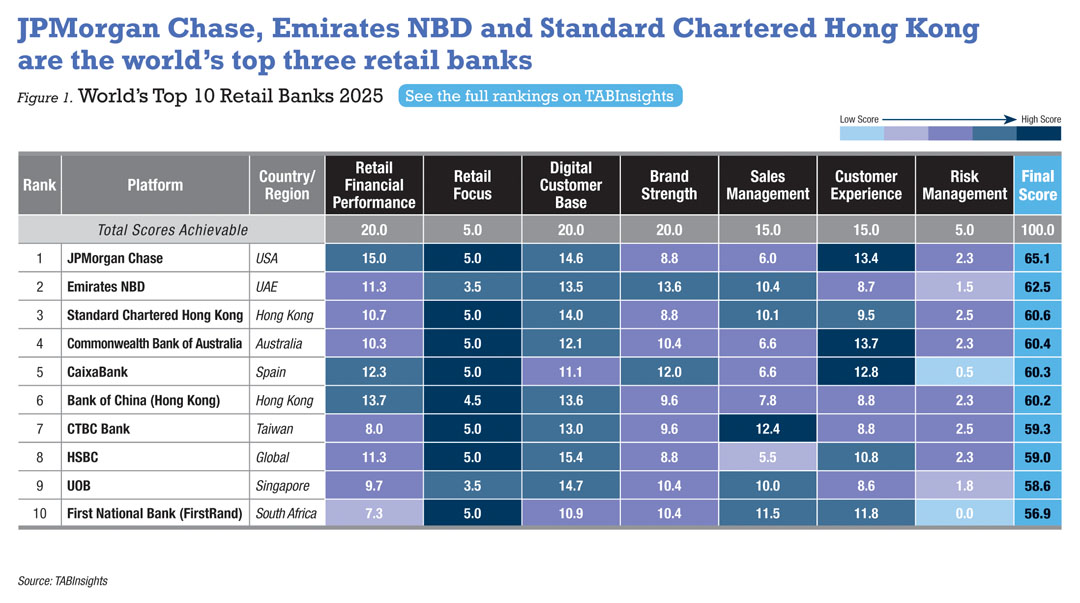

JPMorgan Chase tops the 2025 TABInsights World’s Best Retail Banks Ranking, excelling in retail financial performance, digital customer base and customer experience. This year’s expanded evaluation included the top 50 retail banks globally, with TABInsights assessing their performance across seven critical dimensions, comprising retail financial performance, retail focus, digital customer base, brand strength, sales management, customer experience and risk management.

Emirates NBD and Standard Chartered Hong Kong rank second and third. The top 10 retail banks in this year’s ranking also include Commonwealth Bank of Australia, CaixaBank, Bank of China (Hong Kong), CTBC Bank, HSBC, UOB and First National Bank, a division of FirstRand.

The top 50 retail banks saw a slight improvement in profitability in the financial year (FY) 2023, with the average pre-tax retail return on assets (ROA) edging up from 1.7% in FY2022 to 1.8%, and the average retail cost-to-income ratio (CIR) decreasing from 51% to 48%. Emirates NBD and JPMorgan Chase reported the highest pre-tax retail ROA, at 5.6% and 4.9%, respectively, while Emirates NBD and China Construction Bank reported the lowest retail CIR at 26.6% and 30.5%. Meanwhile, the proportion of digitally active customers and digital sales continued to rise, highlighting a shift towards digital engagement in the banking sector.

Top three retail banks

JPMorgan Chase remained the largest retail revenue generator worldwide, as its retail revenue grew 28% to $70.1 billion in FY2023. This is well above the average of $46.6 billion for the big four Chinese banks. Its retail profitability also improved, with pre-tax ROA increasing from 3.9% in FY2022 to 4.9% in FY2023.

Its consumer and community banking segment serves over 80 million customers and six million small businesses, with approximately 80% of consumer chequing accounts as primary banking relationships. This success reflects JPMorgan Chase’s strategic approach and strong market presence. The bank’s digital transformation has particularly resonated with younger demographics, with millennials and Gen Z making up over 45% of its customer base. Additionally, 76% of customers are digitally active, logging in an average of over 20 times per month.

Emirates NBD’s retail banking division was highly profitable, leading the top 50 retail banks with a pre-tax ROA of 5.6% in FY2023. Its retail revenue grew by 31% in FY2023, primarily driven by record volume growth in customer lending and deposits, supported by low-cost current and savings accounts (CASA), which constitute 77% of total deposits. Higher transaction volumes across foreign exchange, wealth management and cards also contributed, alongside enhanced cross-selling. The bank’s retail CIR remained the lowest among these retail banks, improving from 28.2% in FY2022 to 26.6% in FY2023.

Emirates NBD’s strategic focus on digital banking and regional expansion has been pivotal to its growth. The bank achieved 94% digital customer onboarding in retail banking, with 93% of services and 98% of transactions fully automated, supported by innovations like ENBD X, Liv and WhatsApp Banking.

Standard Chartered Hong Kong achieved strong growth in retail deposits and maintained a CASA ratio above 60% for a solid, low-cost funding base. In FY2023, the bank saw stronger retail revenue growth, improved retail ROA and a better retail CIR. Adopting a digital-first strategy, the bank strategically enhanced its deposit and wealth management services. The revamped mobile app has driven customer satisfaction and digital sales growth. Its myWealth platform offers personalised investment insights, while data analytics tailors services to meet client needs.

.jpg)

Other top 10 retail banks

The top 10 retail banks in this year’s ranking also include Commonwealth Bank of Australia, CaixaBank, Bank of China (Hong Kong), CTBC Bank, HSBC, UOB and First National Bank.

Bank of China (Hong Kong) excelled in the retail financial performance dimension, achieving the highest growth in retail revenue among the top 50 retail banks in FY2023, excluding HDFC Bank, which saw a 65% rise in retail revenue following its merger with its parent HDFC. Bank of China (Hong Kong)’s retail revenue grew by 51% in FY2023, driven by higher interest rates, which led to an 86.8% increase in net interest income, partly offset by a decline in non-interest income. Its pre-tax retail ROA improved from 1.4% in FY2022 to 2.7% in FY2023. The bank has capitalised on opportunities in Hong Kong, the Greater Bay Area and Southeast Asia by leveraging its cross-border expertise, digital innovations and regional partnerships.

In the sales management dimension, First National Bank and CTBC Bank performed well, reporting the highest ratios of non-interest income to total income in their retail banking businesses, at 48.5% and 41.4%, respectively. First National Bank saw a 12% growth in retail non-interest income in FY2023, driven by customer acquisition, increased activity and higher transactional volumes. CTBC Bank’s retail non-interest income grew by 16% in FY2023, driven by wealth management and credit card offerings. HSBC performed strongly in the digital customer base dimension, with 54% of wealth and personal banking customers being monthly active mobile users in FY2023, up from 49% in FY2022. Additionally, the proportion of sales completed digitally increased to 49% in FY2023, compared to 43% in FY2022. Overall, banks are increasingly focused on improving customer experience and efficiency through innovation to meet the evolving needs of customers in a digital world.

View the World’s Best Retail Banks Ranking here