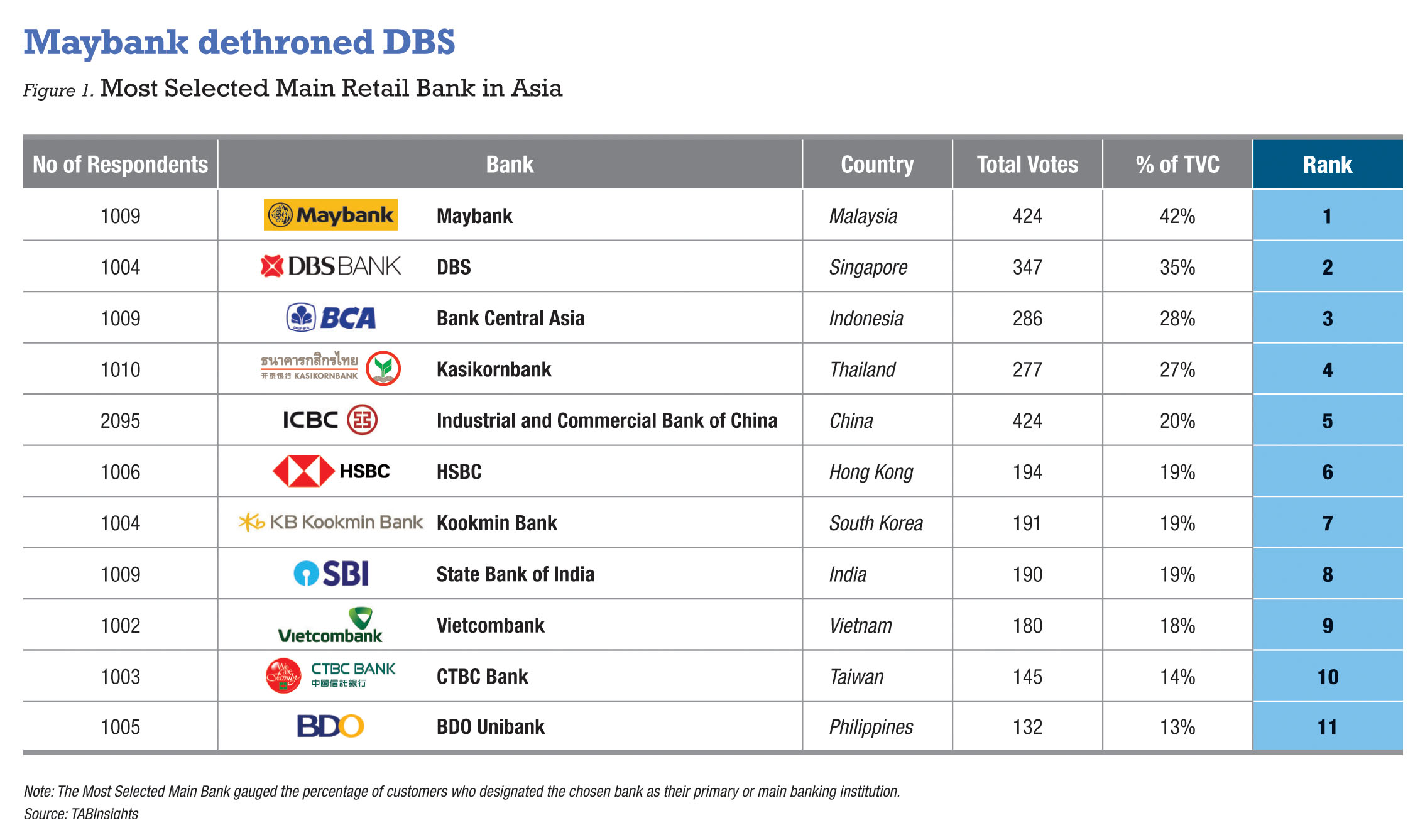

The results of the 2024 BankQuality™ Consumer Survey were characterised by a balance of tradition and anticipation of the future as Asian banks respond to customers’ diverse financial needs. The latest TABInsights survey shows Malaysia’s Maybank leading as Asia’s Most Selected Main Retail Bank with 42% of the total vote count, followed by Singapore’s DBS Bank at 35%, and Indonesia’s Bank Central Asia (BCA) at 28%.

The ranking was determined through a survey conducted in January 2024 that gathered feedback from 12,000 bank customers across 11 markets in Asia Pacific. The survey specifically gauged the percentage of customers who designated the chosen bank as their primary banking institution. Institutions that received less than 100 responses were not included in the final ranking.

Results reflect strong customer retention in 10 out of 11 markets

Maybank has overtaken DBS as the Most Selected Main Retail Bank in this year’s survey, securing 42% of the total vote count in Malaysia. This is slightly lower than the previous year’s figure, where Singapore’s DBS led with 65%, and now holds 35%, placing it second. Indonesia’s Bank Central Asia (BCA) occupies the third spot with an impressive 28%, showcasing its significant market influence. Kasikornbank from Thailand is in fourth place with a close 27%, and China’s Industrial and Commercial Bank of China (ICBC) completes the top five with a 20% share. Tied for the sixth position are Hong Kong’s HSBC, South Korea’s Kookmin Bank, and India’s State Bank of India (SBI), each achieving 19%. Vietnam’s Vietcombank is in ninth place with 18%, while Taiwan’s CTBC Bank and the Philippines’ BDO Unibank are in 10th and 11th positions with 14% and 13%, respectively.

Maybank leads in customer service, digital innovation and network bandwidth

Maybank tops this year’s ranking, reflecting strong customer preference over Singapore’s DBS Bank. DBS, in second place, remains a key player in Singapore’s banking sector with a significant following. BCA in the third spot was commended by customers for digital innovation and responsive service. Its significant presence in Indonesia speaks to its considerable market capitalisation and a continuous push towards modernising customer experiences.

In fourth place, Thailand’s Kasikornbank prioritises customer service and secure transactions. The Industrial and Commercial Bank of China (ICBC) is in fifth place, demonstrating its proficiency in efficient services and compliance standards.

Tied for the sixth position are India’s SBI, Hong Kong-based HSBC, and South Korea’s Kookmin Bank. This reflects SBI’s extensive reach and reliability, HSBC’s blend of legacy and modern banking, and Kookmin Bank’s customer-friendly policies and significant branch network, all of which underscore their enduring reputation and consumer trust.

Vietnam’s Vietcombank, in the ninth position, reflects confidence in its state-managed operations that guarantee security and rapid transactions.

Securing the 10th position, CTBC Bank from Taiwan demonstrates growth through its user-friendly services and extensive ATM network. BDO Unibank from the Philippines takes the 11th place, marking a shift in consumer preference from the previous year and recognising its weekend services and wide accessibility.

Crucial role of adapting to customer needs

The results of the TABInsights survey showcase the dynamic nature of Asia’s financial institutions, from Maybank’s commanding lead to BCA’s digital presence and BDO Unibank’s accessibility, to the customer-centric approaches of Kasikornbank and CTBC.

These rankings highlight the banks’ alignment with evolving customer needs, serving as a measure of the industry’s strength and direction. This environment, where traditional banking meets innovation, caters to the complex needs of a diverse clientele, establishing these banks as key enablers of economic development and lifestyle enhancement across Asia.

About the BankQuality™ Consumer Survey

The BankQuality™ Consumer Survey (BQS) and Rankings are based on the responses of 12,000 customers in 11 markets and over 200 institutions across Asia. The survey conducted in January 2024 is a digital consumer feedback channel developed by The Asian Banker. It surveys customers in each of the 11 markets in Asia to understand their engagement, experience, and satisfaction with their retail financial services institutions based on services, channels and products. The country scores that are based on a normal score from 0 to 1 are then translated into a regional z-score to standardise the country votes and rank them regionally.

“traditional banking meets innovation, caters to the complex needs of a diverse clientele, establishing these banks as key enablers of economic development and lifestyle enhancement”