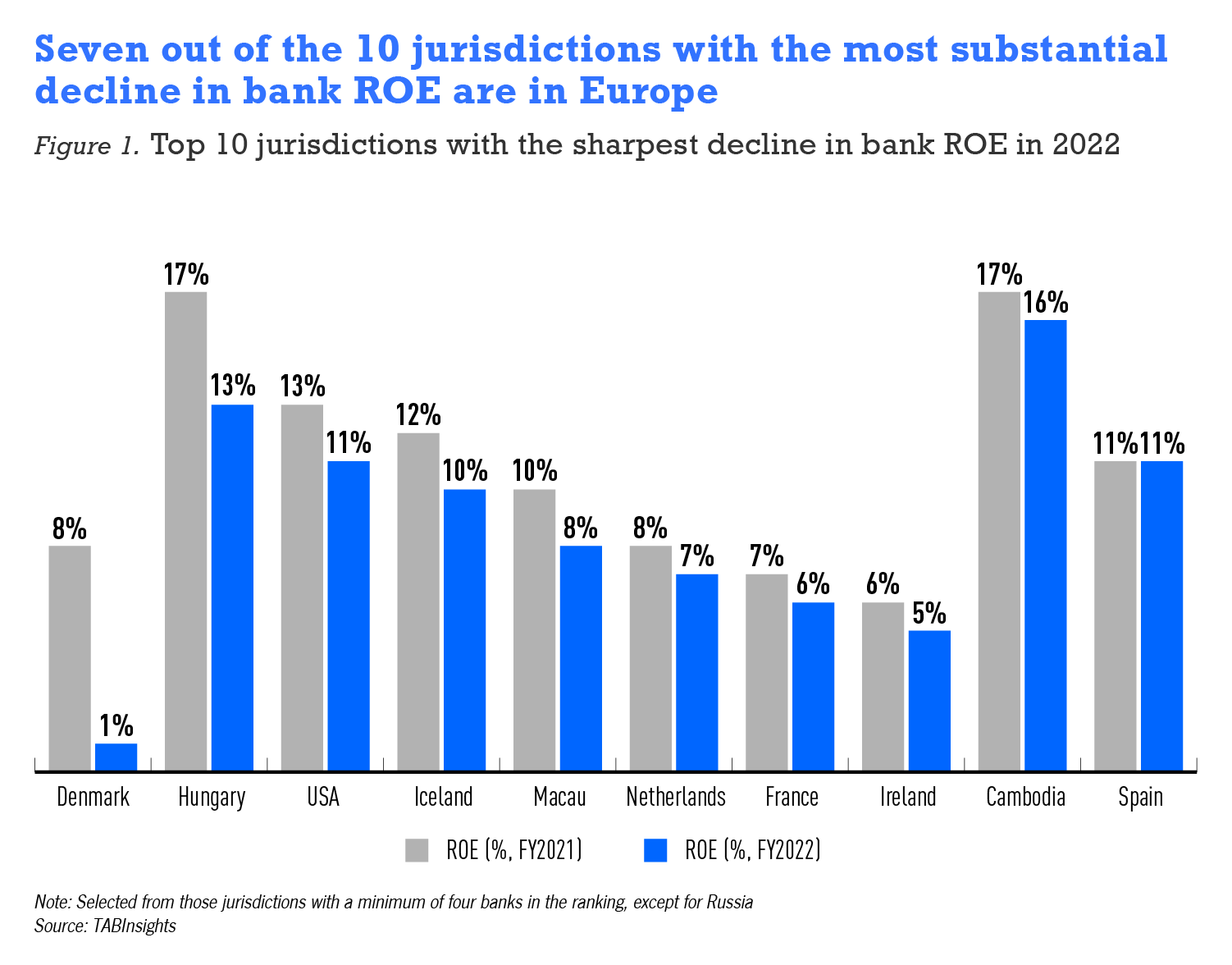

- Denmark’s decline in bank ROE in 2022 driven by Danske Bank’s net loss

- Average ROE of US banks fell from 13.5% in 2021 to 10.5% in 2022, largely driven by higher provisions for credit losses

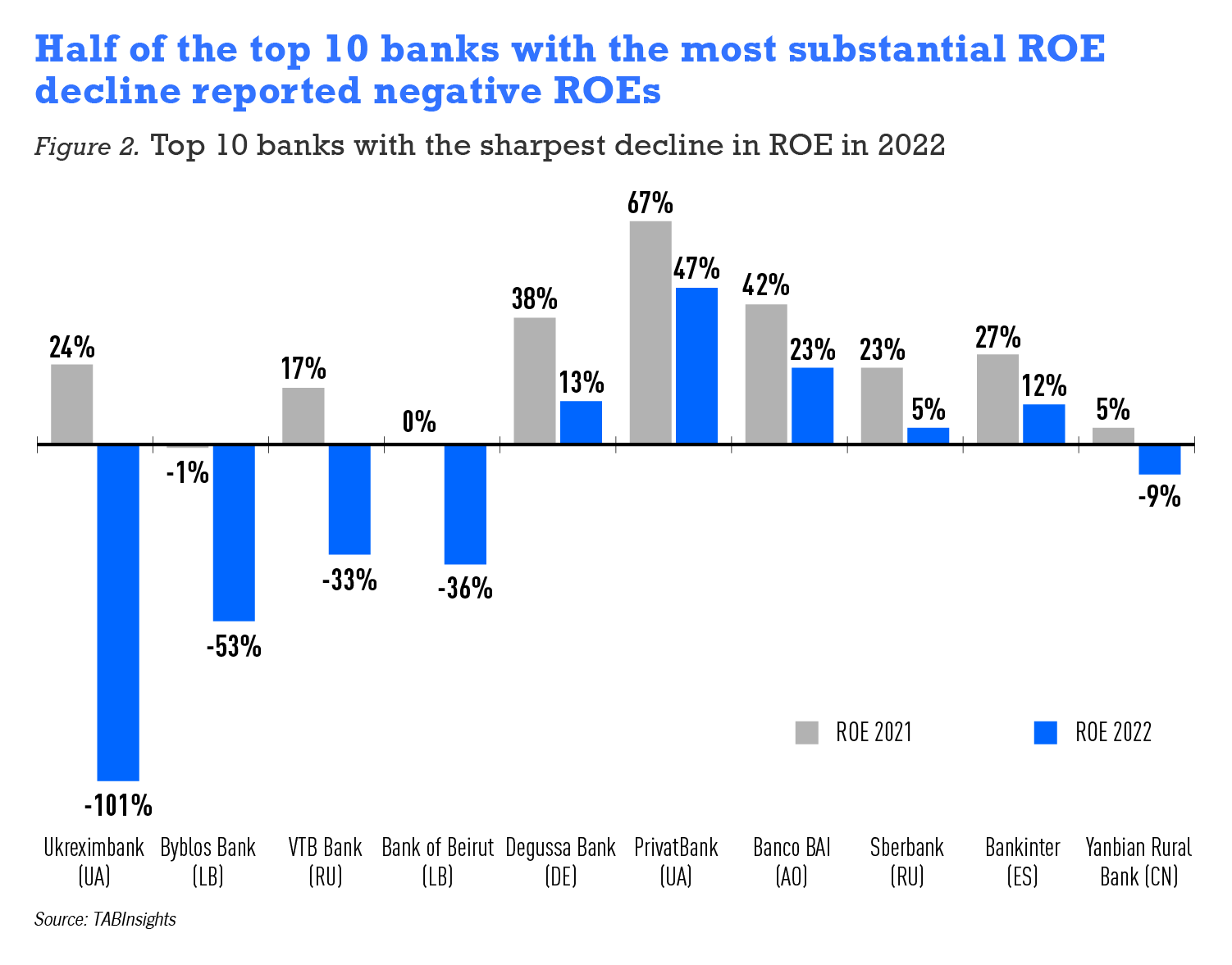

- Top 10 banks with the sharpest ROE drops—two from Lebanon, two from Russia, two from Ukraine, and one each from Angola, China, Germany, and Spain

The world’s largest 1,000 banks saw a slight drop in the asset-weighted average return on equity (ROE) from 9.9% in 2021 to 9.8% in 2022, according to the . TAB Global 1000 World’s Largest and Strongest Banks Ranking 2023

Among jurisdictions with at least four banks featured in the TAB Global 1000, the top 10 with the most substantial decline in bank ROE included seven from Europe, two from Asia Pacific (Cambodia and Macau), and one from North America.

In the top 10 jurisdictions with the most substantial decline in ROE are banks in Denmark, France, Hungary, Iceland, Ireland, the Netherlands, and Spain. In contrast, banks in Turkey, Greece, Portugal, Austria, Romania, Italy, Czechia, and Germany observed an increase in average ROE. Consequently, the overall average ROE of European banks remained stable at 8.3%.

Denmark saw the largest decline

The average ROE of banks in Denmark saw the most significant decline, primarily driven by Danske Bank, the country’s largest, with ROE plunging to -2.7% in 2022, contrasting with 7.5% in 2021. In 2022, Danske Bank reported a substantial net loss of DKK 4.6 billion ($649 million), compared to a net profit of DKK 12.9 billion ($2.1 billion) in 2021. This downturn was primarily due to a provision of DKK 13.8 billion ($15.3 billion) related to money-laundering in Estonia. In December 2022, Danske Bank admitted guilt, concluding an extended investigation and forfeiting $2 billion to resolve the probe into illicit payments linked to its now-closed Estonia branch.

US banks’ ROE declined mainly due to increased loan-loss provisions

In terms of regions, only North America witnessed a decline in average ROE for 2022, despite the fact that it still outperformed the global average. The primary cause of this loss was the significant decrease in average ROE of US banks, which fell from 13.5% in 2021 to 10.5% in 2022. This was largely due to US banks reinforcing their credit loss reserves in response to economic uncertainties.

JPMorgan Chase’s ROE fell from 17% in 2021 to 13.2% in 2022, as higher provision for credit losses resulted to a 22.1% year-on-year (YoY) decrease in net profit, However, its pre-provision profit increased by 4% YoY. Citigroup saw a 32% YoY decline in net profit in 2022, resulting in an ROE drop from 10.9% in 2021 to 7.5% the same year. Wells Fargo also witnessed a reduction in ROE from 12.4% in 2021 to 7.3% in 2022. Aside from an increase in credit-loss provisions, the drop can be attributed to lower fee income and higher operating losses, which include expenses for litigation, regulatory issues, and customer remediation related to various cases.

Top 10 banks with the sharpest decline in ROE

Apart from banks in Lebanon, Russia, and Ukraine, the top 10 banks experiencing the most significant decline in ROE also include BAI from Angola, Yanbian Rural Commercial Bank from China, Degussa Bank in Germany, and Bankinter in Spain.

Yanbian Rural Commercial Bank exhibited the lowest ROE among Chinese banks in the TAB Global 1000 World’s Largest and Strongest Banks Ranking 2023. The bank’s ROE has consistently declined, falling from 21% in 2016 to 5% in 2021 and plummeting further to -9% in 2022. This decline is attributed to a narrowing net interest margin, dropping from 3.6% in 2016 to 1.1% in 2022, along with decreased non-interest income and increased operating expenses.

In 2022, its operating income plummeted by 44% YoY, resulting in a net loss of $116 million, a stark contrast to the $67 million net profit in 2021. In addition to weakened profitability, the bank encountered further challenges, including a rise in the gross non-performing ratio from 2.1% in 2021 to 4.3% in 2022, due to substantial lending to private enterprises and cross-provincial lending.

Additionally, the bank’s capital adequacy ratio dropped from 11.9% in 2021 to 9.6% in 2022, and its Tier 1 capital adequacy ratio fell from 9.4% to 7.9%. By the end of 2022, it failed to meet regulatory requirements for non-systemically important banks, as its Tier 1 capital adequacy ratio had fallen below 8.5%, and the total capital adequacy ratio had dipped under 10.5%.

See the full list of the World’s Largest Banks here

See the full list of the World’s Strongest Banks here