- Technology companies, both in and out of Asia, have started expanding into processing payments.

- Non-bank financial institutions continue to define the benchmark for customer experience, and technology adoption.

- Digital transformation on an organisational level continues to be a competitive advantage for banks who choose to shift and explore new and developing technologies.

When DBS Bank dropped its “Living Breathing Asia” brand promise in May 2018, which had been running for more than 11 years, and replaced it with “Live more, bank less”, it was emblematic of an entire industry in transformation. This was not a marketing gimmick but a clarion call for long term survival, aimed at guaranteeing the bank a place where it can compete for the next few decades. The economics of the retail financial services business has been changing: Commercial banks were once at the apex of the financial value chain, unrivalled in their network reach and heavily shielded by national regulators which kept entry barriers high. Today, they are forced into a digital ecosystem and into playing a different role, defined by the interaction of a growing number of network players, where success is not only determined by the capabilities of the bank but also by the ties and relationships it can create with customers, counterparts and competitors.

Harnessing the power of disruption

Nowhere else in the world except in China can players ranging from banks, non-banks and even regulators harness network effects to such a scale and degree as to make it the epicentre of digital finance. While it is too early to say whether the rise of financial market place platforms, that offer the ability to engage with different financial institutions from a single channel may become the dominant model, the likes of “big tech” companies such as JD Finance, Baidu, Tencent and Ant Financial are taking on the role of demand aggregators for an outsized customer base far exceeding what the banks could offer. Today, the Chinese financial market places are the largest of any kind in the world. JD Finance, for instance, offers on its platforms products and services of more than 400 banks, 120 insurance companies, 110 fund managers and more than 40 securities companies, including fully automated credit assessment.

Meanwhile, harnessing network effects also means accelerating the fintech ecosystem. Japan’s Rakuten Ichiba, this year’s winner in The Asian Banker Best Frictionless E-Commerce Proposition category, has set its eye to become the number one membership company in the world, where 1.2 billion members can benefit from a unique ecosystem that processes $32 billion per year. The Rakuten ecosystem includes fintech services, cards, payments, credit card, mobile payments, securities, investment management, and insurance.

Elsewhere in Asia, technology companies have started expanding into processing payments. China’s Alipay and WeChatPay are on a regional and global expansion drive no longer just targeting Chinese tourists. Amazon launched “Pay Balance” in April 2017 in India, followed by Google Tez in September 2017. Compared to the largest private-sector banks in India that have approximately 20 million registered mobile users, it took Tez four months to onboard 14 million users and completed 300 million transactions in 200,000 of the 630,000 towns and villages in the country. And the leap from payments to a full-fledged financial services company isn’t far-fetched as demonstrated by Alipay when it launched Yu’e Bao service in June 2013, a money market fund for shoppers’ deposits in their Alipay accounts. In the US, non-banks started offering various forms of lending, including through Apple’s instalment loans for iPhone purchases and Amazon’s small-business lending.

From the Excellence programme, The Asian Banker has observed innovative collaboration and competition between banks and “big tech” companies. In China, banks are actively plugging into the market place economy while at the same time those platforms are developing their own products.

However, the tech companies do not have all the trump cards. In 2017, the Chinese regulators have started to curtail the financial services activities of tech companies, subjecting them to the same regulatory and capital requirements and restrictions as their conventional banking counterparts. As a result, Chinese market place players which were enjoying fast growth until 2014 but have now to reach out to banks to leverage their capital and balance sheet strength to introduce new products and customers.

In November 2017, ICBC and JD Finance jointly premiered “ICBC Xiaobai”, the first scenario-embedded purely digital bank in the industry, which is fully embedded on the JD.com platform. “ICBC Xiaobai” allows customers to open ICBC accounts directly in the app of JD Finance, combining a traditional banking account with a third-party payment platform.

Evidently, banks are concerned that big techs will move directly into banking, capitalise on their relationship with millions or billions of customers, and leverage on huge data sets that could help them build sophisticated risk and financial models. The differences may not be as clear cut as they appear though. Big tech is moving some parts of the transactions downstream, while banks are keen on moving upstream. Commercial banks’ unique advantage is that they know the regulations and having decades of unique risk management and modelling experience, something many big techs and fintechs are just starting to figure out.

2017 was also the year when regulations finally caught up with the supposed disruptors. For example, the biggest challenge now facing China’s burgeoning peer-to-peer (P2P) lending sector is compliance. New rules governing the said industry will come into force in August 2018, and according to available drafts, these will impose a limit of $29,400 (RMB200,000) on lending to individual borrowers, will require the lenders to carry out stricter background checks on all clients, and will establish strong contractual relations with custodian banks.

Setting the benchmark for user experience

Non-bank financial institutions continue to define the benchmark for (digital) user experience. Amazon offers a one click ordering functionality and keeps track of all users search and purchase history to offer relevant content that sets the industry standard for the use of advanced data analytics. Similarly, Alipay’s emphasis on doing the small things right in order to improve the customer experience offers invaluable lessons to the industry.

By working relentlessly to increase payment authorisation rate it was able to strengthen users’ perception of convenience, reliability and trust towards the service and ultimately, to the company.

On the other hand, Kakaobank’s success is partially based on the unbundling of complex financial products into more discrete offering that customers can easily access and is a strategy that Paytm Payments Bank pursues too in India.

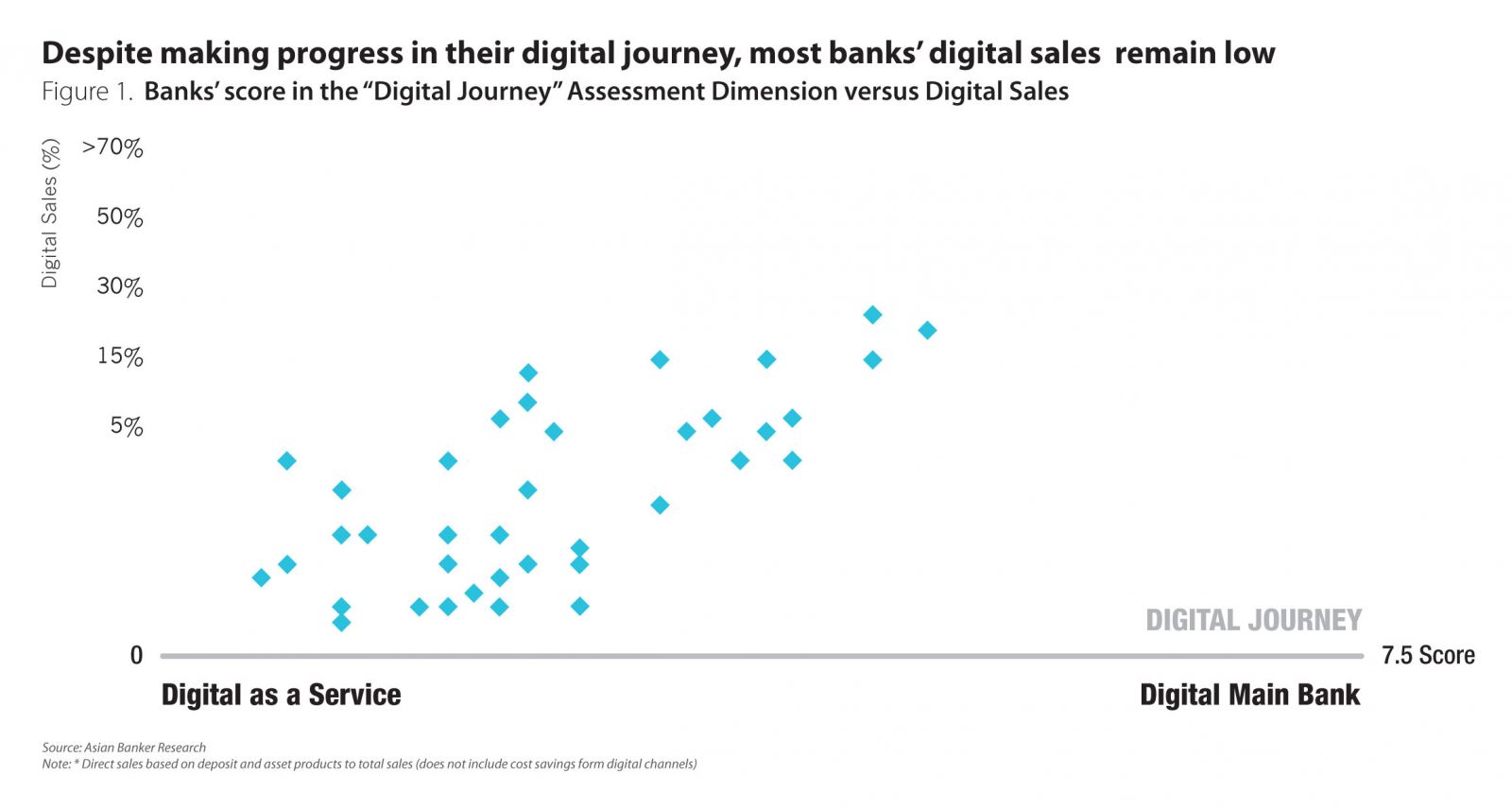

For big techs, the ultimate goal has been to become an everyday part of customers lives, something that banks were slow to pick up initially. The industry understands this well and what banking has to be: Simple, seamless and invisible that customers have more time to spend on things they care about. In banking terms, it means better user experience and less friction. Yet, the operational challenge for banks goes beyond and above improvements in digitising the front- and back-end, though many emerging markets across Asia, the Middle East and Africa are just standing at the brink of implementing this. In Korea, Japan, Australia, Singapore, Taiwan, Hong Kong and the UAE, where the digital playing field among commercial banks is beginning to level out, the next phase of change will be crucial, overhauling a corporate culture to improve the ability to shift mind-set, how to think about serving digital customers, and increase agility in a siloed organisation structure to achieve digital main bank status (Figure 1).

Mapping the digital journey of commercial banks

In this year’s programme, we overhauled our balanced scorecard for Best Retail Bank. Out of the ten dimensions we assess, an entire new assessment dimension called “digital journey” accounts for the progress in digital transformation. The overall score takes into account the banks’ portion of digital customers, branch process automation at the front- and back-end, the portion of 100% straight through processed digital products, the contribution of digital sales to total revenue, key digital initiatives, partnerships and programmes in innovation, the onboarding of new customers through digital channels and related cybersecurity philosophy and methodology, manpower developments, and digital agility of the organisation. The portion of digital sales, asset and liability products that are fully straight through processed, for the best Australian banks ranges between 25% and 29%. But elsewhere the picture is somewhat more sobering. At DBS Bank, digital sales contribute about 4% to retail banking revenue. Only 12% of the top 100 retail banks in the region count more substantial sales from digital with full digital account opening a major focus for most banks. But less than 5% are addressing the transformation on an organisational level. One aspect banks aim at is to create a “fintech-like” workforce that is consumed with disrupting and redesigning the customer experience. But to make staff think more like employees in Apple and Facebook cannot be done in classrooms. Leading banks create platforms to expose employees to different working cultures to design, develop, and closely work with start-ups and the broader fintech community.

While banks recognise the comprehensive impact of digital transformation, often their businesses are just deploying conspicuous technology. For example, some are increasing process automation and straight through processing, building digital infrastructure within their existing business and operational silos, and not at the same time improving their capability to understand the profile and behaviour of customers. In this ‘digital as a service’ stage, digital initiatives are component driven and most service offerings are implemented at the front end.

We observed that banks are well able to define and articulate their digital main bank agenda but often resist to make changes to areas such as organisational structures or hierarchies; duties and roles of staff and the way decisions are being made and communicated. Some banks have a hard time to identify the starting point and the stakeholders or change agents to drive digital transformation.

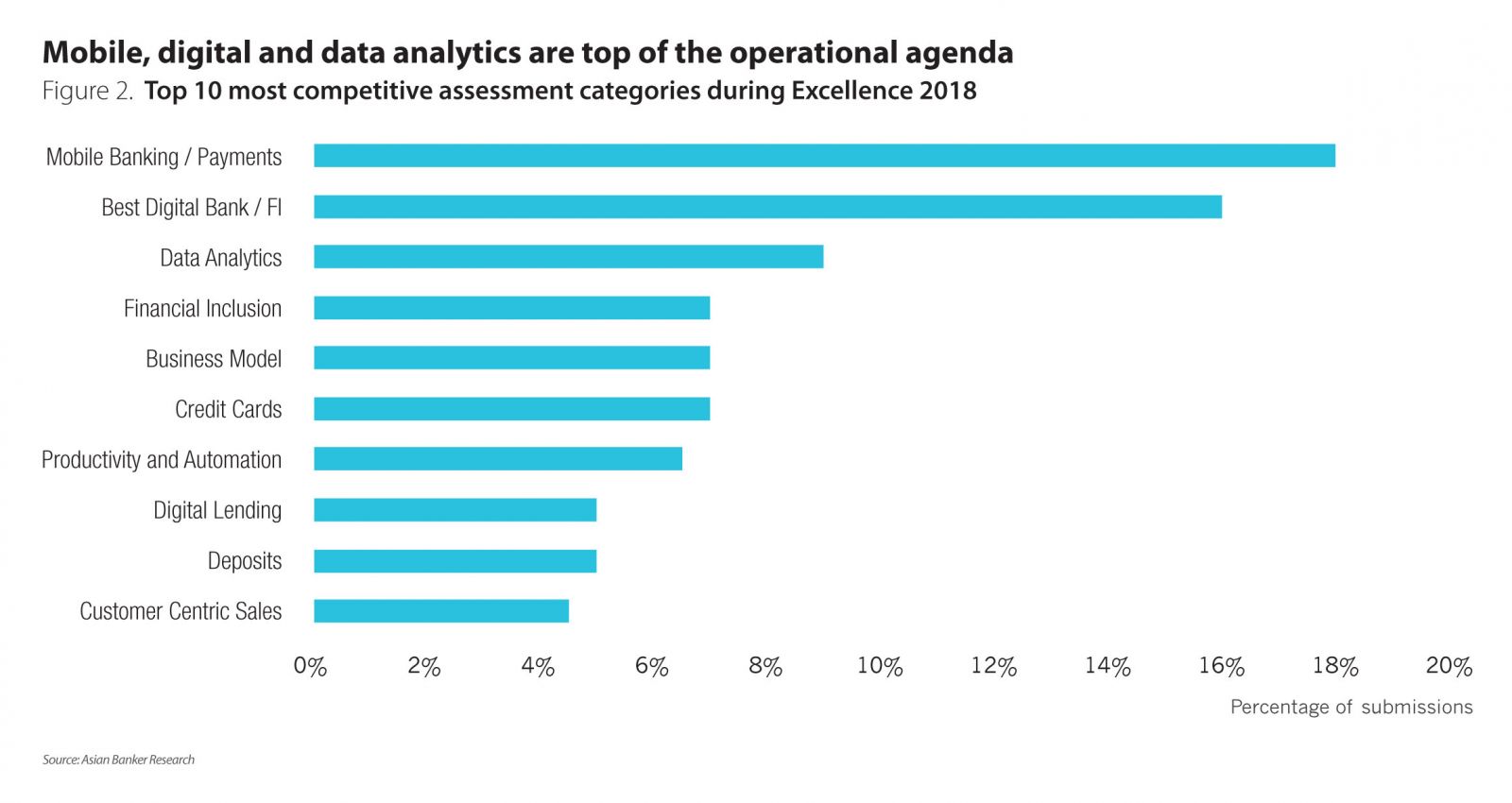

This year’s programme was, unsurprisingly, centred on digital and big data, with mobile increasingly becoming the leading device to deliver financial services. Internet banking, which ranked among the top three in the previous year’s programmes, dropped out of the top ten areas altogether. In data analytics, the most interesting business cases originated from big tech and financial technology companies. WeLab Hong Kong, for instance, which is evolving from a business-to-consumer (B2C) online lending to a business-to-business (B2B) technology play, is building a diverse mix of revenue streams in risk technologies, customer experience solutions and mobile applications. Interestingly, despite all things moving digital in payments, the focus on credit card continues to be resilient, although the growth curve for cards in force in some market such as Singapore and Hong Kong and are already on the decline. In Hong Kong, growth in spending from digital wallets is outpacing credit cards in 2017. Offerings are becoming more targeted such as the credit card launched jointly by China Merchants Bank and “Arena of Valor”, which is the largest mobile game in China, with over 150 million users. Real-time location-based offers and card servicing from the mobile app have increasingly gained competitive advantages.

In the area of productivity and automation, robotic process automation (RPA) helps to improve customer experience and bring down the cost to serve. In deposits we observed that strategies have been shifting. The major trend in savings and deposit products is to combine it with automated savings goals and personal financial savings tools, with a strong focus on educating children to save.

Measuring digital transformation

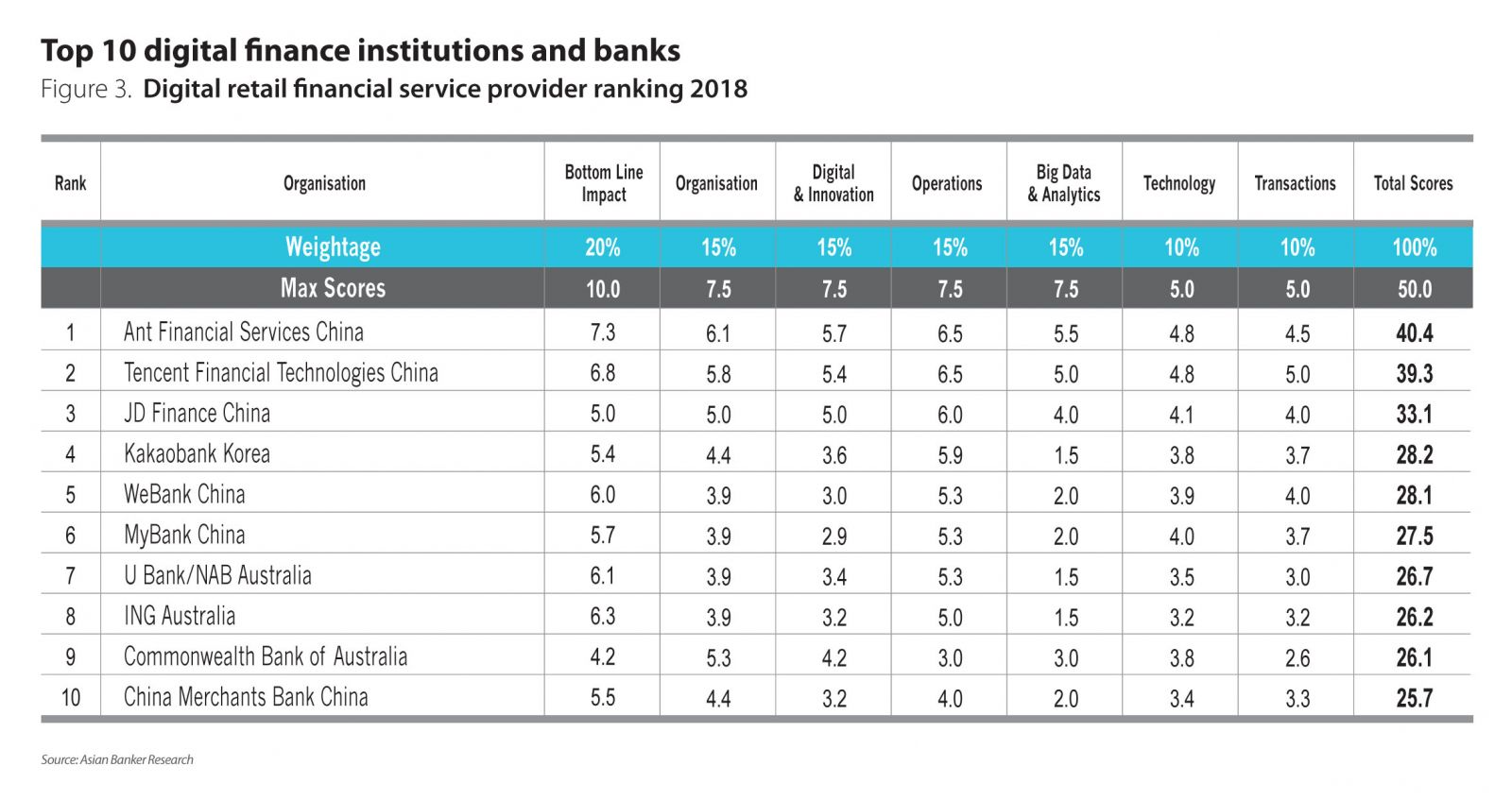

We have developed a methodology to track and rate financial institution on their journey to become highly competitive digital players, a ranking which takes into account commercial banks, digital only banks, platform-based ecosystems and technology companies.

The Asian Banker Digital Bank and Finance Institution (FI) 2018 ranking across more than 16 markets in Asia Pacific, the Middle East and Africa revealed that the most competitive digital retail financial institutions come from China, and the elite club of the top ten, representing all non-bank financial players, are exclusively from China, Korea and Australia.

The biggest gap between players in Greater China and the rest is found in big data and how their platforms make use of sophisticated visualisation, augmentation and predictive modelling. What sets those apart is the scope of data processing, the availability of large data pools to all relevant parts of their organization and a strategic focus on artificial intelligence (AI).

Despite the progress commercial banks have made in moving towards becoming digital “main banks”, the results indicated that, their digital capabilities remain too marginal to be competitive. This makes commercial banks vulnerable to lose further share in their core businesses and the next generation of customers. Unlike Europe and the US, more than half of all digital only banks covered in The Asian Banker Excellence programme are spin-offs of commercial banks.

Banks bought into the consulting myth over the last decades that technology was a peripheral competency, causing them to outsource massively. In hindsight, it was one of the biggest tactical management failures in the operational history of commercial banking. Like their counterparts in China, Kakaobank made technology and information technology (IT) its core backbone, building every system by themselves. This allowed them to easily upgrade and make changes, enhancing operational stability and market flexibility.

Most digital-only banks in Asia, the Middle East and Africa emerged in a relatively short period of time since 2016 – but are facing a difficult road as they continue to lack scale and profitability. Out of 20 digital-only banks and retail financial services providers we looked into, only eight organisations made money, while none of the ones launched since 2016 is profitable as of today. In some instances, the lack of a full banking licence and the absence of e-know-your-customer (e-KYC) regulation provided a drag on customer acquisitions. This is in particular prevalent in emerging markets such as India, Indonesia and Vietnam. However, some digital experiments have faltered. Despite a promising start, Shinhan Bank’s Sunny Bank had to be revamped in 2018 due to lack of distinction between its parent platform and the digital bank.

Emerging Technologies

Banks also need to worry on the technology front. Financial technologies ranging from cloud to big data, AI, machine learning, augmented reality, cybersecurity, blockchain, and internet of things (IoT) will continue to be a key battle ground for the next decade. Chinese financial institutions and a few leading commercial banks in the Excellence Programme such as Commonwealth Bank of Australia are ahead in their innovation by actively experimenting, meshing, and commercialising a variety of technologies, and building an environment where one can do these activities. According to Ant Financial, its “smart customer service”, a voice recognition system launched in 2015 for automated customer calls, recently surpassed human performance in terms of customer satisfaction. Ant Financial also utilises machine learning technology for its image-recognition system to aid vehicle insurance claims.

Chatbots are relatively low-cost advancements in AI adoption. Currently, text-based chatbots are more common among banks compared to voice-based virtual assistants. Consumers already use voice for 20% of their Google searches now and are likely to use it for 50% within a few years, so they are starting to expect banking by voice too. A majority of bankers agree that voice will be the most important channel for their business after mobile, and they are looking at 2018 as a pivotal year. On average, the current generation of bots recognises about 200-300 banking tasks or intentions with a variation of up to 60,000 ways to ask. Yet, current versions need to become “smarter” to deliver the value customers wants: Bots, whether text or voice that will effectively facilitate the completion of a goal. More advanced players include payments but the business goals are to build proprietary services on top of a generic AI engine, the ability to cover multiple core businesses, and the application of products and services. Notwithstanding the ambitious outlook for AI, there are still fundamental issues with the technology. For example, chatbots are far from being able to handle queries like a human operator. The portion of calls that need to be referred to a human banking agent as well as a failed “handshake” between bot and agent to ensure a frictionless user experience is high and it will take some time before we see significant improvements.

In the blockchain space, Hana Financial Group Korea and Webank were this year’s highlights in the programme. Hana launched a global initiative to create a cross-border shared-loyalty platform, Global Loyalty Network (GLN), by connecting various loyalty programmes in each country with a wide network of global partnership platforms, built on blockchain technology. Built as a business-to-business proposition, it has partnered with more than 22 financial institutions globally and projects $3.1 billion transaction value with accumulated GLN end users of 58 million by end of 2018. Webank, the digital banking arm of Tencent Financial Technologies, applies real time settlement for its micro loan business with its funding partners. Since Webank borrows its funds from the interbank market, it aimed at making the process of doing business with them as transparent and efficient as possible. By running a blockchain application on top of its underlying platform developed in house, Webank was able to reduce friction with its partners. Whenever a customer borrows, returns are split in real time. Transaction reporting and reconciliation, which was done traditionally via batch drop at the end of the day is now any time of the day. We expect additional full blown commercial blockchain applications, particularly in payments and remittances, to go live in 2018.

Those players work with other peers to experiment and learn from each other. They do this as part of an ecosystem. Emerging technologies encourage financial institutions to come together to look for collaborative opportunities. It is going to be less about process efficiency, and more about the experiences banks can provide to a customer in collaboration with a larger ecosystem of players. Hence, banks may need to create partnerships, platforms or other highly innovative solutions to compete effectively.

In doing so, banks are ramping up their application programme interface (API) infrastructure and we expect the bulk of APIs to be live and active in 2018 and 2019. DBS Bank launched one of the world’s largest banking API developer platforms in November 2017, which included more than 150 APIs across 20 different categories and 50 live partners. The bank introduced “Smart Buddy”, one of the world’s first school-based wearable tech savings and payments platform and mobile application. The bank utilised APIs by incorporating one with the Health Promotion Board to share health-related data.

On the other hand, Taishin International Bank’s omni-channel platform (TOCP) is an API portal offering an integrated platform for the transaction of e-commerce between merchants and digital wallet vendors of which they have more than 11 as of May 2018. In effect, not only digital wallet vendors can manage the digital payment business but e-commerce/retail vendors can build “credit-card on-file” and “token-service” into their apps to achieve this kind of emerging payment business.

Outlook

With the mismatch between consumer expectations and banks service deliveries, technology companies are setting the standards in simplicity, speed and service through new designs and delivery of financial services. We see more emphasis put on service as a key to selling but benchmarks in this field are set by technology companies not by the banks. In financial inclusion, new players are making a positive difference.

Banks are forced into new roles at a speed that many may not be ready to. Digital transformation on an organisational level continues to be on top of leading banks’ agenda. However, moving the entire organisation into digital will take time and requires massive investments into human resources and corporate change. Increasing levels of digitisation and automation will make lending eventually fully automated. This will be in conjunction with automated and autonomous systems and market places driven by AI, bots and other emerging technologies. A new breed of global digital FIs may be formed in the next decade usurping the old order of universal commercial banks. This is an evolution which also may be visible in the rise of new global payments systems during the digital age.