Become a member of working group to watch this full video.

The Future Banking Working Group (FBWG) invites you to our upcoming session, “Elements of Consumer Credit Risk Analysis,” a strategic and tactical workshop exploring how financial institutions in developing markets can apply practical approaches to credit risk analysis, improve model transparency, and leverage alternative data to assess creditworthiness more effectively.

In this interactive session, we’ll discuss:

- How do rule-based and statistical credit models differ, and why do many lenders in developing markets still rely on scorecards rather than modelling?

- What are the key steps in developing a credit scoring system, including data collection, cleaning, transformation, and feature engineering?

- How can financial institutions utilise alternative data sources, such as telco, device, psychometric, and open finance data, to score underbanked consumers?

- What are the main challenges in using alternative data, including concerns around privacy, standardisation, and compliance?

- How are AI and large language models making credit scoring faster, more scalable and more accessible, and what does this mean for traditional banks?

Agenda (SGT)

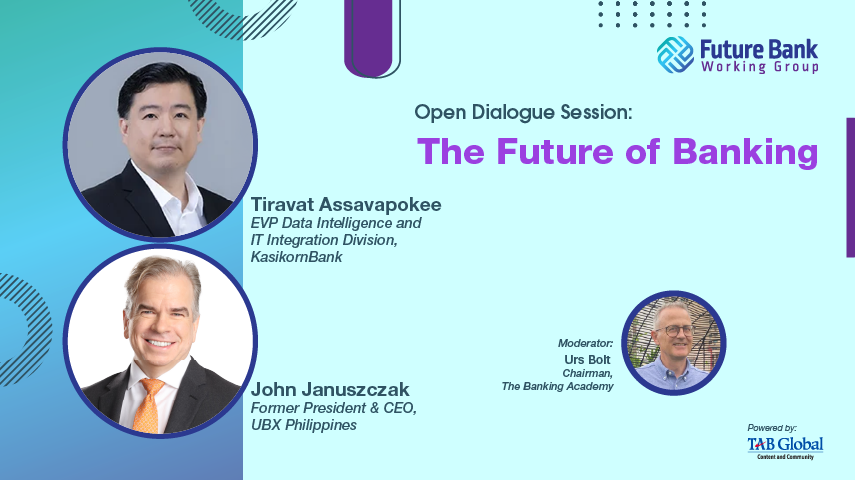

- 4:00 PM – 4:10 PM: Introduction of Elements of Consumer Credit Risk Analysis workshop by Urs Bolt, Chairman, The Banking Academy

- 4:10 PM – 4:40 PM: Presentation by Christo Georgiev, CEO and Founder, LenderLink

- 4:40 PM – 5:00 PM: Q&A