Become a member of working group to watch this full video.

Join us as we explore:

- Understanding Agentic AI and how it represents a paradigm shift in its capabilities.

- Exploring how Agentic AI enhances internal operations by streamlining workflows, automating repetitive tasks, and improving decision-making to create more efficient and responsive retail banking services.

- How Agentic AI is transforming customer interactions by delivering hyper-personalised experiences, anticipating individual needs, and providing proactive, tailored solutions that deepen trust and loyalty.

- Real-world applications of Agentic AI, such as hyper-personalised customer engagement, advanced fraud detection, autonomous wealth management, and dynamic risk modeling.

Agentic AI is not just a tool, it’s a transformative force reshaping the competitive landscape of banking. This is your opportunity to gain tactical insights, anticipate the future, and position yourself at the forefront of AI-driven finance.

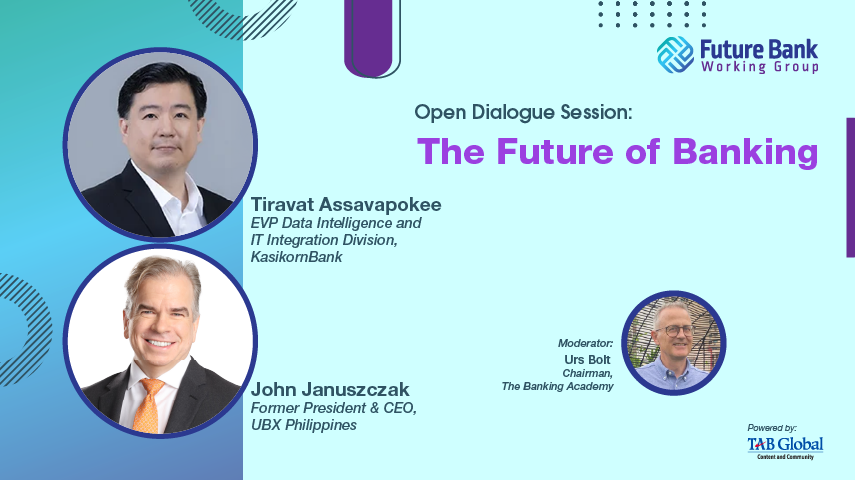

Agenda:

- 5:30 PM – 5:40 PM: Opening Remarks by Urs Bolt, Chairman, The Banking Academy

- 5:40 PM – 6:10 PM: Presentation by Sina Wulfmeyer, CDO, Unique FinanceGPT

- 6:10 PM – 7:00 PM: Q&A Session followed by Closing Remarks