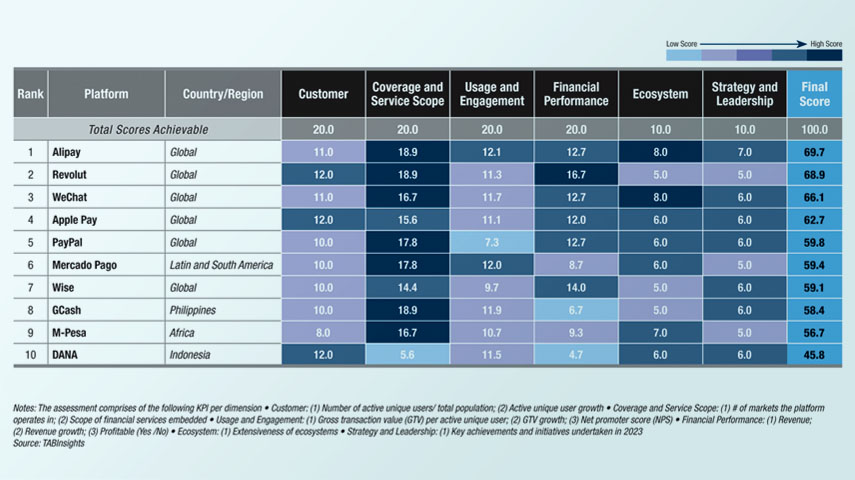

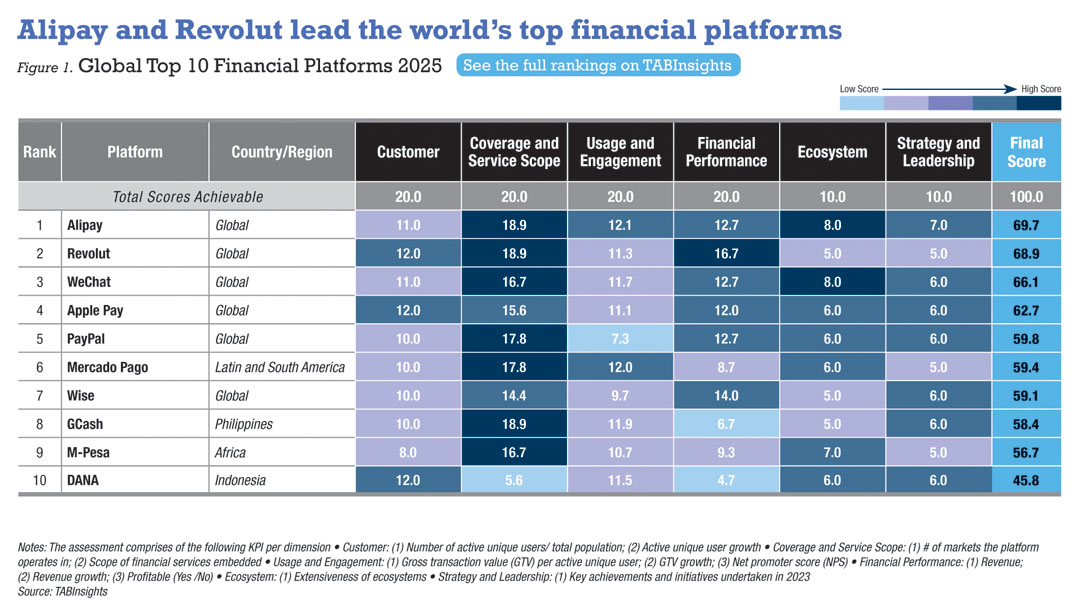

Alipay and Revolut have secured the top positions in the TABInsights World’s Best Financial Platforms Ranking for 2025. This year’s evaluation has been expanded to cover the top 30 financial platforms in the world, which are technology-driven ecosystems offering a wide range of financial services and tools through digital interfaces. They harness technology to simplify, innovate and democratise access to financial products and services.

A thorough assessment of leading financial platforms was conducted using a six-dimensional balanced scorecard, focusing on customer, coverage and service scope, usage and engagement, financial performance, ecosystem, and strategy and leadership. Platforms such as WeChat, Apple Pay, PayPal, Mercado Pago, Wise, GCash, M-Pesa and DANA are also ranked among the top 10 in the world. Notably, half of the top 20 financial platforms serve Asia primarily, highlighting the region’s prominence in financial platform adoption.

Platforms that integrate a wide range of services, including remittances, cards, savings, loans, investments and insurance, have become a powerful force in reshaping the financial landscape. By leveraging vast user bases, data analytics and open banking capabilities, these platforms deliver personalised financial products that enhance user convenience and engagement.

Strategic partnerships are vital for financial platforms that are expanding their services, with collaborations across banks, fintechs, retailers and even telcos, boosting reach and functionality. Some financial platforms are partnering with digital banks to enhance financial capabilities, gaining faster market entry, streamlined compliance, better risk management and increased user trust.

Advanced technologies, such as artificial intelligence (AI) and machine learning, enhance platform capabilities through predictive analytics, real-time data processing and hyper-personalisation. These tools enable platforms to offer targeted financial products, improve fraud detection, ensure secure transactions and boost customer engagement.

Furthermore, such platforms play a vital role in promoting financial inclusion by expanding access to underserved populations, while also integrating sustainable environmental, social and governance (ESG) factors into their operations.

Asia leads the adoption of financial platforms

Asia is leading the way in financial platform adoption, with half of the top 20 financial platforms in this year’s ranking primarily serving the region. High smartphone penetration, a relatively young population and a rapidly growing economy are driving demand for integrated financial services.

In China, WeChat and Alipay set the benchmark for financial platforms by merging financial services with daily activities and transactions. Both ecosystems feature mini programmes, which are lightweight applications embedded within the platforms that eliminate the need for separate downloads. WeChat introduced mini programmes in 2017, followed by Alipay. These offer seamless access to various services, boosting user engagement and solidifying their roles as key financial platforms in China’s digital landscape.

Southeast Asia has a large population that often lacks access to formal financial services. Platforms such as GCash, Grab, TrueMoney, Touch ‘N’ Go, Boost, DANA, GoTo, OVO and MoMo are expanding rapidly to meet the needs of an increasingly digitally savvy populations. GCash serves nearly 80% of the population in the Philippines, advancing financial inclusion with AI-powered tools. Grab has expanded from a ride-hailing service to a comprehensive platform across eight Southeast Asian countries, forming strategic partnerships with banks to enhance its financial services. TrueMoney supports underserved communities with microloans, investment options and accessible insurance plans. With 88,000 agents across seven Southeast Asian countries, TrueMoney has steadily grown, providing essential financial services to an expanding user base. MoMo serves one-third of Vietnam’s population, with over 50,000 business partnerships and collaborations with more than 70 banks and financial institutions, playing a key role in the country’s digital transformation.

Meanwhile, platforms such as PhonePe, Paytm and MobiKwik in India, PayPay in Japan, Kakao Pay and Toss in South Korea are accelerating the use of digital financial services across their respective markets. PhonePe, backed by Walmart, has expanded its ecosystem beyond payments to offer insurance, lending and wealth management, aiming to replicate its unified payments interface (UPI) success. With over 530 million users and 40 million merchants, PhonePe processed over 7.7 billion transactions monthly, achieving an annualised total payment value of $1.5 trillion in the financial year 2024. PayPay has integrated banking, insurance and securities services, achieving rapid growth through an aggressive expansion strategy, bolstered by SoftBank’s Vision Fund and key partnerships, including with Paytm in India.

.jpg)

Financial platforms are gaining increasing traction beyond Asia

The adoption of financial platforms in Western markets has been slower in comparison to Asia, largely due to the dominance of specialist apps and data privacy concerns. However, platforms such as Revolut, Wise, Klarna, N26, Curve and Lydia are gaining traction by offering multifunctional digital solutions that cater to a shift towards integrated services.

Revolut has expanded into financial services such as stock trading and cryptocurrency exchange. It has experienced rapid global user growth fuelled by its aggressive expansion strategy. In addition to its low-cost, cross-border money transfer services, Wise has expanded into multi-currency accounts, debit cards and business solutions, while also launching Wise Assets, an investment option, across 11 European countries. Klarna has also broadened its financial services beyond buy now, pay later (BNPL) by offering personal accounts and savings features, with 150 million global active users.

Meanwhile, platforms such as PayPal have expanded by adding new features, making them more comprehensive. PayPal, for instance, has integrated services like savings accounts, credit offerings, BNPL and cryptocurrency trading to better serve its users. Financial platforms are also making strides in Africa, the Middle East and Latin America. In Africa, M-Pesa remains the leading financial platform, serving 66 million customers. Other notable platforms include Fawry in Egypt and Max it, launched by Orange in November 2023 to streamline digital services for users in Africa. In the Middle East, tech-savvy youth and growing smartphone use are driving financial platforms like Careem, which has expanded from ride-hailing to a multi-service platform.

In Latin and South America, platforms such as Mercado Pago, Inter and PicPay provide a wide range of financial products, including cards, savings, loans, investments and insurance, driving innovation and financial inclusion across the region. Mercado Pago, the fintech arm of e-commerce giant Mercado Libre, has become a one-stop financial hub. Inter, once a traditional bank, has transformed into a comprehensive financial platform in Brazil and has expanded into the United States.

Alipay stands out with its vast ecosystem and extensive coverage

Through technological innovation, global expansion and a strong commitment to user engagement, Alipay remains a leading financial platform worldwide. With over four million mini programmes embedded into the platform, Alipay integrates payment solutions, financial services and lifestyle offerings, providing users with a full range of financial services, from peer-to-peer payments to insurance, loans and wealth management.

High transaction volumes, strong user adoption and the effective cross-selling of financial products drive Alipay’s robust revenue generation and growth. Its gross transaction value (GTV) per active user exceeds $25,000, surpassing competitors such as Wise’s $11,692, PayPal’s $3,588 and Kakao Pay’s $3,339.

With more than 35 international wallet and bank payment partners, Alipay+ connects 1.6 billion user accounts to over 90 million merchants across 66 markets, facilitating seamless cross-border transactions. This expansive global reach further strengthens Alipay’s presence and solidifies its position as a leader in digital finance.

Revolut excels in user acquisition, coverage and financial performance

Revolut has evolved from a travel-focused currency exchange application into a multifaceted financial platform, offering services such as foreign exchange, banking, cryptocurrency trading and stock investments. Its customer base expanded by 45%, growing from 26.2 million in 2022 to 38 million in 2023 across 38 countries, and surpassing 50 million in 2024, a testament to the appeal and effectiveness of its diverse product offerings.

The platform’s remarkable growth is fuelled by its diversified revenue model, strategic market expansion and robust customer engagement. In 2023, Revolut’s transaction volume surged by 58%, reaching $871 billion, outpacing platforms such as Wise at $150 billion, N26 at $123 billion and Klarna at $93 billion. In addition, its gross profit soared by 114%, and it posted a record pre-tax profit of $545 million, underscoring the scalability and efficiency of its business model. By 2024, Revolut’s valuation hit $45 billion, reflecting strong investor confidence in its vision to become a global financial powerhouse.

Platforms such as Mercado Pago, Wise and GCash are also key players in the top 10

Mercado Pago, initially launched to facilitate payments on Mercado Libre’s e-commerce platform, has since transformed into a comprehensive fintech ecosystem, offering services such as digital wallets, prepaid cards, credit solutions, insurance and investment products. Its integration within Mercado Libre allows it to leverage a large user base, unlocking cross-selling opportunities that drive customer loyalty and provide valuable transactional data. Mercado Pago has experienced remarkable growth, with monthly active users rising from 41.5 million in the third quarter of 2023 to 56.2 million in the same period of 2024.

Mercado Pago, plays a crucial role in the digital transformation of Latin and South America’s financial landscape, focusing particularly on the underbanked population. Nearly two-thirds of its total payment volume comes from transactions outside of Mercado Libre’s marketplace. As of the third quarter of 2024, Mercado Pago’s credit portfolio reached $6 billion, reflecting a 77% year-on-year growth across all products and markets.

Beyond international money transfers, Wise offers financial services such as multi-currency accounts, debit cards and borderless financial tools. It expanded its offerings with the introduction of Wise Assets Interest and Stocks products, now available in 11 European markets. Wise has seen remarkable growth, expanding its active customer base by 29%, from 10 million in FY2023 to 12.8 million in FY2024. More users are taking advantage of multiple features, with over two-thirds of new customers joining through referrals, benefiting from low customer acquisition costs.

Fuelled by its profitable, cash-generative business model, Wise’s profit before tax surged by 229% in FY2024. This growth was driven by significant customer expansion, increased engagement, rising interest rates and effective cost management.

GCash, the Philippines’ leading financial platform, serves 94 million users and six million merchants. It offers loans, BNPL, wealth management and insurance, expanding via key partnerships with Lazada, Visa and Alipay. GCash Overseas enables remittances, while AI-driven tools boost financial inclusion. In 2023, it disbursed $2.1 billion in loans, doubling 2022 figures, and grew wealth services with 9.5 million GSave users, 5.8 million on GFunds and 16.3 million insurance policies sold.

Going forward, financial platforms will continue to evolve, driven by innovation and the demand for integrated services. The ongoing growth and development of these platforms will be crucial in enhancing the accessibility, security and personalisation of financial services.

View the World’s Best Financial Platforms Ranking here